Facebook unveiled plans for a new cryptocurrency that the social media giant hopes will one day trade on a global scale much like the US dollar.

Called Libra, the new currency will launch as soon as next year and be what’s known as a stablecoin — a digital currency that’s supported by established government-backed currencies and securities. The goal is to avoid massive fluctuations in value so Libra can be used for everyday transactions in a way that more volatile crypotcurrencies, like bitcoin, haven’t been.

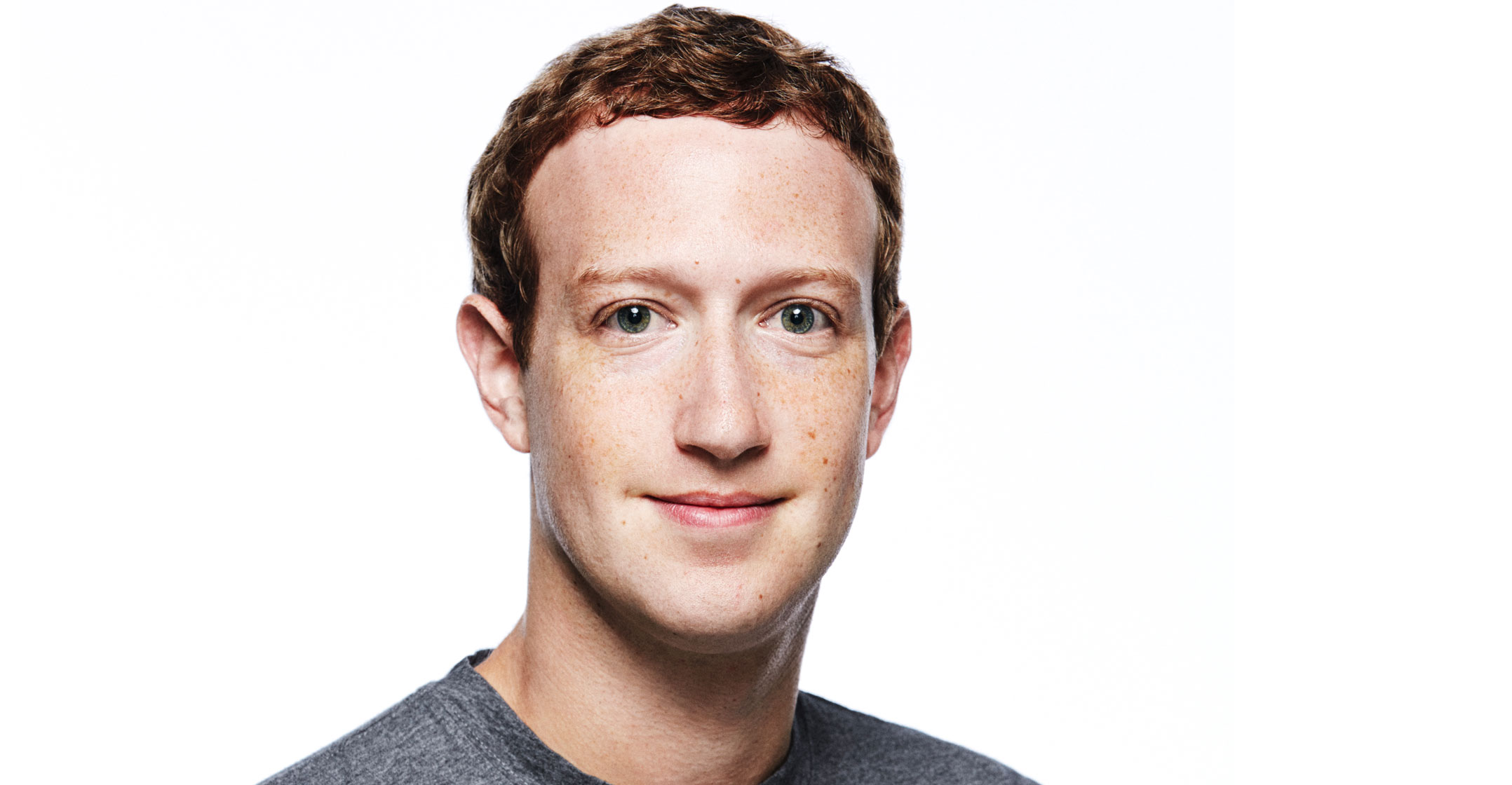

Libra is the culmination of a year-long effort to devise an easy way for Facebook users to send and receive money through its messaging services. Private messaging is one of the company’s fastest growing products, and CEO Mark Zuckerberg is embracing this by integrating all Facebook’s messaging products to let users communicate between its different apps.

This focus comes at a time when user growth of the main social network has plateaued in some major markets, and regulators are scrutinising the company’s frequent privacy failures. Payments are a potential way to turn messaging into a business that complements Facebook’s advertising operation, which generates almost all its revenue.

To come anywhere close to matching the US dollar for utility and acceptance, Libra will need to be widely trusted. So Facebook and its partners are mimicking how other currencies have been introduced in the past.

“To help instil trust in a new currency and gain widespread adoption during its infancy, it was guaranteed that a country’s notes could be traded in for real assets, such as gold,” the companies wrote in a white paper. “Instead of backing Libra with gold, though, it will be backed by a collection of low-volatility assets, such as bank deposits and short-term government securities in currencies from stable and reputable central banks.”

Price stability

The total number of Libra can change, and new digital coins can be issued whenever someone wants to exchange their Libra for an existing fiat currency, so the price shouldn’t fluctuate any more than other stable currencies, according to David Marcus, head of the Facebook blockchain team that’s spearheading the project.

“It would make a scenario where there’s a run on the bank completely impossible, because we are backed one-for-one,” he said. Libra will also be audited, he added, an important step in an industry with limited transparency.

Facebook has closely guarded its crypto plans for more than a year, though many of the details have already been reported by news outlets.

Marcus, who used to run Facebook Messenger, said Facebook plans to build a new digital wallet that will exist inside Messenger and its other standalone messaging service, WhatsApp. Once Libra is up and running, the currency and the digital wallet should make it easier for people to send money to friends, family and businesses through the apps. Libra will run on the so-called blockchain, a database that can use millions of computers to verify transactions, eliminating risks that come with information being held centrally by a single entity. Facebook created a new subsidiary, called Calibra, to build the new wallet and focus on the company’s blockchain efforts.

Marcus, who used to run Facebook Messenger, said Facebook plans to build a new digital wallet that will exist inside Messenger and its other standalone messaging service, WhatsApp. Once Libra is up and running, the currency and the digital wallet should make it easier for people to send money to friends, family and businesses through the apps. Libra will run on the so-called blockchain, a database that can use millions of computers to verify transactions, eliminating risks that come with information being held centrally by a single entity. Facebook created a new subsidiary, called Calibra, to build the new wallet and focus on the company’s blockchain efforts.

Facebook’s track record in payments and commerce has been spotty. A few years ago, it began letting people buy flowers or hail an Uber through its Messenger service. Those features have not been huge hits. In 2010, it began offering Facebook Credits, a way to buy virtual goods inside Facebook games. But in 2012 it scrapped Credits, and in 2013 it started working with third-party services like PayPal process some payments. Facebook’s revenue from “payments and other service” was less than 2% of total sales in 2018.

If successful, Libra could make Facebook a much bigger player in financial services. That’s a big “if”, though. Cryptocurrency companies have been trying to build cross-border, digital currencies on the blockchain to disrupt traditional banking and payments for a decade. Nothing has caught on at the scale of traditional money yet.

When it finally arrives, Libra will be late to a party that’s been going on so long, many of the party-goers have either left or collapsed. Some past attempts to make coins usable for commerce, such as bitcoin, haven’t widely caught on yet because price volatility mainly attracted traders and speculators. Predecessor stablecoins, like tether, have been used by some traders to park funds in during times of high volatility, but have not been broadly adopted for commerce.

US regulations may represent another hurdle for Facebook. Creating a digital currency doesn’t just require buy-in from financial institutions who need to accept it, and consumers who need to trust it, but it requires approval from regulators, too. The Securities and Exchange Commission has shut down about a dozen businesses issuing their own tokens for violations of securities law. Marcus said Facebook has been in contact with regulators and central banks, but added that the company hasn’t received a “no-action” letter from the SEC yet. That would have safeguarded the project from regulatory action by the agency.

Libra Association

One way Facebook hopes to appease regulators is through the Libra Association, a governing body tasked with making decisions about Libra. At least 27 other firms, including Visa, Uber and PayPal, are part of the group. Marcus described these members as “co-founders”, and said they will have an equal say in how the cryptocurrency is managed.

“Facebook will not have any special privilege or special voting rights at the association level,” said Marcus, the former president of PayPal. “We will have competitors and other players on top of this platform that will build competing wallets and services.”

All Libra Association members are putting a minimum of US$10-million into a reserve to help support the cryptocurrency’s value. This buy-in comes with voting privileges. However, the association’s governance structure is still in flux, and most of the group’s crucial decisions, including the creation of its charter, have not yet been decided, according to several members of the group. They asked not to be identified discussing private details.

Libra’s timing could also pose challenges. Facebook is being investigated by the US Federal Trade Commission over the company’s privacy practices. Some have called for the company to be broken up, including senator Elizabeth Warren and Facebook co-founder Chris Hughes. Asking consumers to put more trust in the social media giant, and giving Facebook a strong entry into the world of digital payments and banking, will likely draw further criticism.

Libra’s timing could also pose challenges. Facebook is being investigated by the US Federal Trade Commission over the company’s privacy practices. Some have called for the company to be broken up, including senator Elizabeth Warren and Facebook co-founder Chris Hughes. Asking consumers to put more trust in the social media giant, and giving Facebook a strong entry into the world of digital payments and banking, will likely draw further criticism.

The company plans to keep financial data gathered from Libra users separate from Facebook user data. That’s why Facebook’s digital wallet will exist under the Calibra subsidiary, which will house user transaction data on separate servers, Marcus said. If a WhatsApp user uses her Calibra wallet to send money to a friend or pay a retailer, those interactions won’t be stored alongside her social media profile.

“There’s a clear distinction between Calibra and what Calibra has access to, and what Facebook has access to,” Marcus said. “It’s very clear that people don’t want their financial data from an account to be comingled with social data or to be used for other purposes.” — Reported y Kurt Wagner, Olga Kharif and Julie Verhage, with assistance from Jennifer Surane, (c) 2019 Bloomberg LP