Telkom CEO Sipho Maseko has succeeded where none of his predecessors could. Reuben September, Jeffrey Hedberg and Nombulelo Moholi all tried … or at least they talked tough.

Telkom CEO Sipho Maseko has succeeded where none of his predecessors could. Reuben September, Jeffrey Hedberg and Nombulelo Moholi all tried … or at least they talked tough.

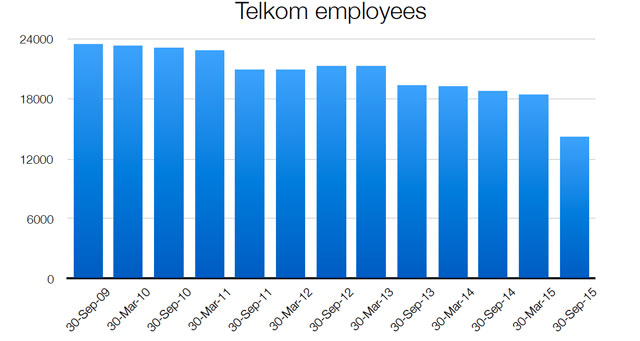

Since Maseko’s appointment in April 2013, Telkom has shed a third of its permanent employees, with most of the cuts coming in the last six months. When he took the job, the telecommunications operator’s headcount was 21 209. By 30 September this year, it had 14 212 employees.

Cutting jobs at Telkom is — and has always been — a political hot potato. But somehow Maseko has managed to quietly run very successful voluntary severance and voluntary early retirement processes over the past few years.

In June, it said it planned to offer these packages to 4 400 employees. The take-up on that offer seems to have been high, given that it expensed R1,5bn related to these two programmes in the six months to September.

Earlier this year, it outsourced certain operations (including supply chain, internal printing and its fixed-line call centres), which affected 1 300 staff. Reports suggest a further 3 400 employees are expected to be moved to outsourced providers.

One area of the business that has been in Maseko’s sights is the field-services division — the engineers and technicians who maintain the operator’s network. In September, it published a request for proposal for “major outsourcing of customer field force services, which may result in the outsourcing of all or part of the customer service fulfilment and assurance functions for products and services in mainly consumer and enterprise markets”.

This would effectively see its field-services unit carved out of the business and outsourced to a provider such as Ericsson or Huawei. The latter is bidding for the contract, according to an October report in Business Day.

It is entirely conceivable that Telkom will end up with fewer than 10 000 employees (excluding the 6 722 in recently-acquired Business Connexion).

The recent steep cuts have also pushed one of Telkom’s key metrics to a level no one ever expected to see. Its measurement of “fixed lines per employee” has hovered in a range near 188 for much of the past six years (remember, the number of fixed lines have been declining over this period, so if it didn’t reduce headcount, this ratio would’ve dropped, which is not positive). At 30 September, that ratio is now at an astonishing 234.

This compares very well globally, but is increasingly a difficult number to measure as operators move away from traditional copper-based services. (It’s also arguably an increasingly irrelevant number.)

The newly articulated target is for employee expenses to be “managed” at 25% of revenue. Operating revenue for the six months to September was R16,3bn (excluding Business Connexion), while employee expenses for the period totalled R4,2bn. Already, that ratio is just over 25% (25,5%), from 29% a year ago. Quite what it will look like with an outsourced network management and field services division remains to be seen.

The easy work in Maseko’s turnaround is done. This includes assembling a strong executive team, outsourcing non-core operations, extricating itself from head office leases in the Pretoria CBD, selling other non-core properties and sharply reducing headcount. The outsourcing of the field-services division won’t be as easy.

Now, Telkom has to grow revenue and customer numbers in a meaningful way (something it hasn’t really been able to do for the best part of the past decade). That’s the far more difficult part of any turnaround. And one wonders whether Maseko’s cut too much.

- Hilton Tarrant works at immedia, specialists in native mobile app and Web development

- This column was first published on Moneyweb and is republished here with permission

- Subscribe to TechCentral’s free daily newsletter