Telkom’s FreeMe looks to be the most competitive data-focused offering in the market, especially when put next to similar packages on the three larger mobile operators.

Telkom’s FreeMe looks to be the most competitive data-focused offering in the market, especially when put next to similar packages on the three larger mobile operators.

When the new packages from South Africa’s “challenger” network are compared to pricing from FNB Connect (the most competitive of the mobile virtual network operators, or MVNOs, using Cell C’s network when it comes to data pricing), the better value is far tougher to discern. A lot depends on out-of-bundle usage, given FNB Connect’s far higher rates (versus those of Telkom Mobile).

However, there is one provider that compares incredibly favourably with Telkom;s FreeMe: Afrihost Mobile. It looks almost identical to an MVNO, but has never called itself that.

The service, launched by the Internet service provider in January (after being in beta since November 2015), runs on the MTN network (in much the same way that FNB Connect and other MVNOs run on Cell C). This followed a highly successful push into the mobile data-only space in 2013.

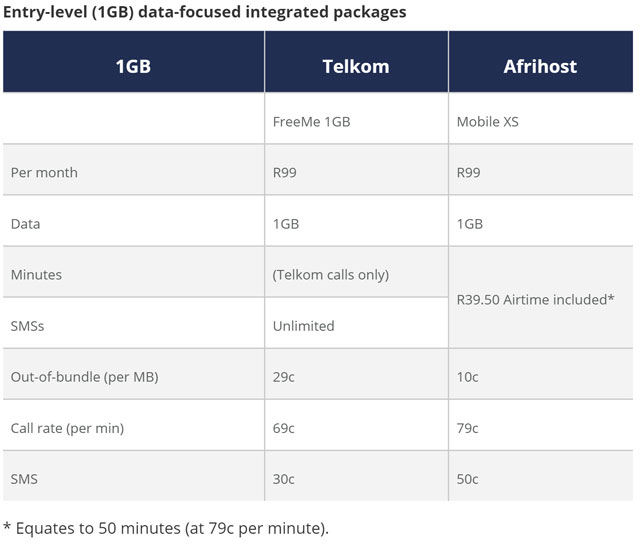

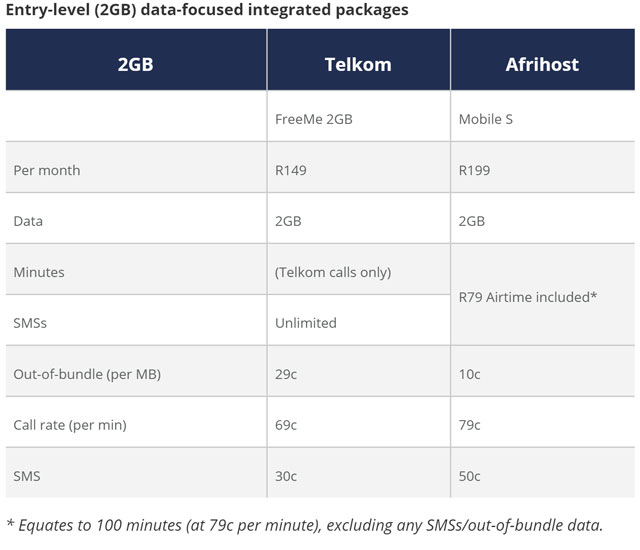

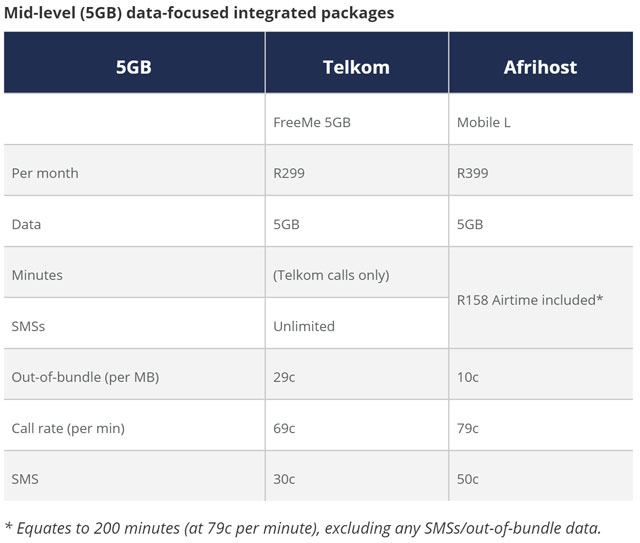

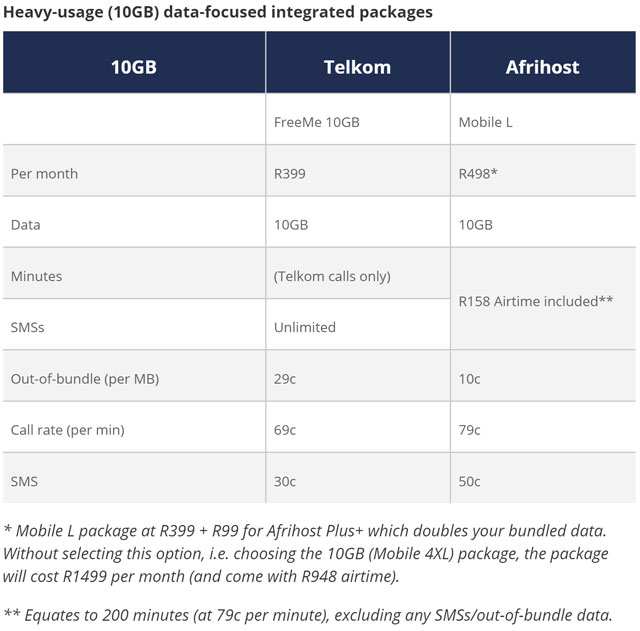

All of Afrihost Mobile’s packages (named according to size from XS to 4XL) are centred on data. The smallest, Mobile XS, is bundled with 1GB of data, while the largest, Mobile 4XL, has 10GB. The packages also all come bundled with an amount of airtime and, importantly, run month to month. Out-of-bundle rates are fairly comparable to Telkom’s at 79c/minute (vs 69c), 50c/SMS (vs 30c) and 10c/MB — the lowest in the country (vs 29c). This makes for a simple comparison to Telkom FreeMe. And, unlike FNB Connect, Afrihost’s offering doesn’t rely on rewards discounts to offset your monthly spend.

Let’s go back to our example (from the FNB Connect comparison) of a “typical” customer who uses 1,1GB of data per month (that is, 100MB out of bundle), makes 38 minutes of calls, including eight minutes to landlines, and sends 10 SMSes.

On Telkom FreeMe 1GB, their bill will come to R148,70. By comparison, on Afrihost Mobile XS, they’ll be in for R104,52 (as the calls, SMSes and nearly half their out-of-bundle data will be covered by the included airtime). That means Afrihost Mobile is 30% cheaper in this example.

If we use the same “typical” (example) customer who exceeds their data bundle by 100MB (that is, uses 2,1GB/month) and makes the same amount of calls and sends the same number of SMSes, their usage will total R198,70 on Telkom FreeMe 2GB. On Afrihost Mobile S, their spend will be the R199 base price of the package, given that they will not have exceeded their bundled airtime in that month.

As with the entry-level packages, the mid-level and heavy-usage ones compare very favourably with Telkom FreeMe, primarily due to the bundled airtime. This means a base amount of calls, a few SMSes and some out-of-bundle data is relatively easily covered by the airtime.

At the higher end, Afrihost also scores with its Afrihost Plus+ offering, which doubles your data allocation for an additional R99/month (along with some other benefits). This means a 10GB package effectively costs the same as the 5GB one (Mobile L) plus the extra R99 (R498 vs the R1 499 list price for Mobile 4XL).

In product marketing, Afrihost points to its “auto-limit” functionality as a main differentiator. This allows you to set a hard spending limit where you’ll automatically get topped up in certain increments (depending on the package) until you reach it.

Afrihost is coy about the number of mobile subscribers it has (it is, after all, a private company). If I were to guess, I’d put it at likely not more than 50 000 (certainly in the tens of thousands).

It’s at an immediate disadvantage when compared to FNB Connect (which offers a similar proposition), given that it simply doesn’t have the marketing clout or customer base which the bank has. And, when compared to the four mobile operators, it’s even smaller still.

The irony, of course, is that Afrihost Mobile was built on top of MTN’s network using some sort of commercial wholesale/MVNO-type agreement 00 it’s not exactly getting these services for free in some sort of sweetheart deal. (The jury is out on whether Afrihost Mobile will continue to use MTN as its network provider in the long term given that the latter is selling its 50,02% stake in the ISP back to management.)

That doesn’t mean that because Afrihost has done this, MTN can trash its current packages tomorrow; its cost structure is completely different to Afrihost’s, its product development process is different and — no matter what they argue — all operators default to protecting voice revenue. After all, voice remains more profitable than data.

Afrihost Mobile shows what’s possible, though. And Telkom has amplified that further with FreeMe, designed to aggressively compete against its larger rivals. Each of these competitor products will slowly (and sometimes not so slowly) chip away at the Vodacom, MTN and Cell C bases — particularly contract customers — until they’re forced to react. Expect moves, and soon…

- Hilton Tarrant works at immedia

- This column was first published on Moneyweb and is used here with permission