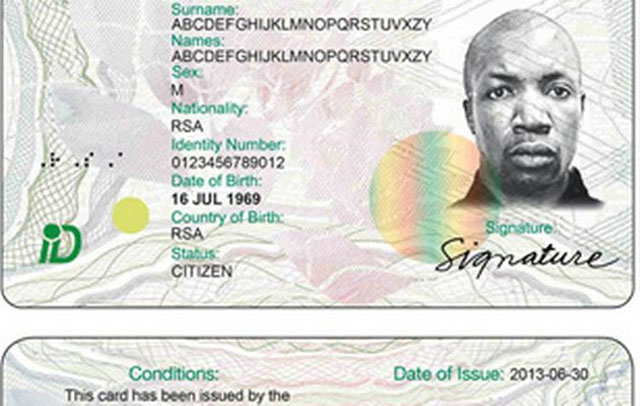

Cabinet has welcomed the official launch of the eChannel pilot project of the department of home affairs, which makes ID applications simpler through technology. The project was launched by President Jacob Zuma earlier this month. The new

Browsing: FNB

About 7 500 employees at Oakbay Investments will lose their jobs at the end of May if the Gupta-owned company’s bank accounts remain closed, staff at the company wrote in an open letter

First National Bank activated 4G/LTE on its mobile network on Monday without much fanfare. The move comes after the bank launched its own mobile network, FNB Connect, in June last year. FNB Connect is a mobile virtual network operator that makes use of

The Guptas and Duduzane Zuma resigned from Oakbay Investments and Oakbay Resources and Energy on Friday to facilitate the sale of the Optimum coal mine from Glencore to Oakbay, the Democratic Alliance claimed. Their resignation “is an insult

So, the Gupta brothers have called South Africa quits. Although it is not really surprising, as virtually everyone but the president and his family have taken a hostile stance against the family, the swiftness of their departure has raised a few eyebrows

Gupta-owned company Oakbay Investments made contact with President Jacob Zuma and cabinet ministers to express its “deep disappointment” at banks closing its accounts, it was revealed in a leaked letter to staff on

First National Bank has closed the accounts of Gupta family-controlled Oakbay Investments, prompting Oakbay to demand an explanation from FNB CEO Jacques Celliers. FNB’s decision

FNB Life announced on Monday that consumers can now take up funeral plans through nearly 6 700 FNB ATMs and Slimline devices across the country. The insurance distributor and administrator’s CEO, Lee Bromfield, said in a statement that making

South Africa’s big four retail banks have been steadily cutting the number of (costly) branches in recent years. That’s no surprise, given the shift in transactional banking to electronic channels. Those transactions that still need some form of physical

While there’s been an outsize (and bizarre) outcry about First National Bank’s decision to close somewhere between 25 and 40 branches in a round of “optimisation”, the country’s big four retail banks have been steadily cutting the number of branches for years