Tencent and NetEase shed more than $60-billion of value on Thursday as investor fears grow that Chinese regulators are preparing to tighten their grip dramatically on the world’s largest gaming industry.

Browsing: Xi Jinping

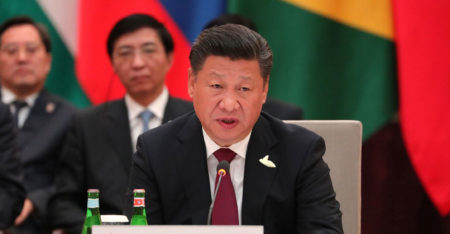

It’s no coincidence that an edict barring kids in China from playing online videogames for most of the week came as the education ministry introduced a new subject to the national curriculum: Xi Jinping Thought.

President Xi Jinping has increasingly emphasised the idea of “common prosperity” as the Communist Party tries to address the country’s wealth gap.

Even a $1.5-trillion selloff may not provide an attractive entry point for equity investors as they grapple with cascading risks in China’s technology sector.

President Xi Jinping put China’s wealthiest citizens on notice on Tuesday, offering an outline for “common prosperity” that includes income regulation and redistribution, according to state media reports.

As $1-trillion evaporated from Chinese stocks last week, some investors realised they hadn’t paid enough attention to the country’s most important man: President Xi Jinping.

When China began opening up to investment four decades ago, many expected that as its economy became more capitalist, its politics also would become more democratic. They didn’t.

US President Joe Biden on Tuesday warned that if the US ended up in a “real shooting war” with a “major power”, it could be the result of a significant cyberattack on the country.

China’s leadership perceives the same set of problems as the West when it comes to Big Tech. But it’s willing to go a lot further to rein in the clout of its tech giants. Investors should be afraid.

China has issued a sweeping warning to its biggest companies, vowing to tighten oversight of data security and overseas listings just days after Didi Global’s contentious decision to go public in the US.