Telkom’s share price has rallied by more than 40% in less than two months, despite a run of bad news from the company. Analysts are buoyed by the change of leadership and some of the decisions taken subsequently, but suggest that without further clarity on Telkom’s long-term strategy, the stock gains may be difficult to maintain.

In recent weeks, Telkom has released far from good annual financial results, taken a R12bn write-down on its network infrastructure, agreed to pay a R200m fine and other penalties for anticompetitive behaviour, gone after one of its former executives for alleged corruption, instituted a R5bn lawsuit against Blue Label Telecoms, and hiked its tariffs in a highly competitive market.

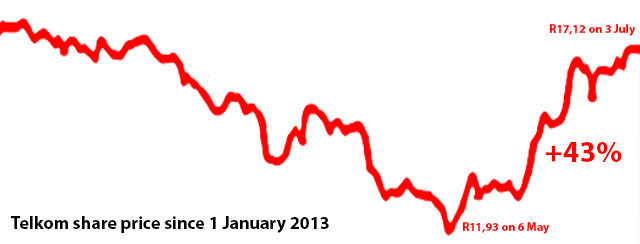

Telkom’s share price bottomed out below R12/share in early May, but was trading above R17/share on Wednesday — an increase of 42,5% from its nadir. On Wednesday, Telkom’s market capitalisation was R8,9bn, more than R3,5bn more than its bottom in May.

Nevertheless, the stock is down 7,4% year on year and off more than 50% over five years.

Kaplan Equity Analysts MD Irnest Kaplan says the company’s annual results, released last month, had three positive factors: healthier cash flow, less tax on cash, and less spending on dividends.

Telkom reported cash flow from operating activities of R7,6bn in 2013 compared to R6,7bn in 2012. “Operating cash flow is up, even though revenue is down,” Kaplan says. Reduced revenue meant it paid R687m in tax in the most recent financial year compared to R939m a year before. Its dividend payments were reduced from R812m to R177m.

“Those three items amount to around R1,5bn and, when you’re a value investor looking at a company arguably undervalued for a long time, you’re very sensitive to the cash performance of the business.”

There’s little doubt Telkom has been undervalued for some time, Kaplan adds, and this goes some way to explaining the R12bn impairment on its network assets. “My gut feeling is that maybe some investors thought this is a sign that despite income statement pressure there is cash in the business and it can produce cash.”

Kaplan says it may be counterintuitive to suggest a R12bn impairment is a good thing, but it “improves all the ratios”.

“The company’s return on equity and its return on assets go up. You could argue it’s just accounting, and just technical, but it does make Telkom look better in the longer term,” he says. “It’s also a sign of taking the blow on the chin and acknowledging that the network is not worth what it’s been listed at.”

Telkom’s new board and the other changes in leadership may also be to thank for the share rally. “I suspect there’s more comfort about the new board,” he says. “There are some really capable people there, the chief financial officer [Jacques Schindehütte] is very capable, and the chairman [Jabu Mabuza] is known for being a no-nonsense guy. Sipho Maseko [the recently appointed CEO] is highly regarded, too. So, there’s lots of business experience on the board now where previously there were many government appointees.”

Despite the rally, Telkom has to find ways to arrest its declining revenue and customer numbers, it needs to clarify the future of its mobile business, and it faces the same problems other fixed-line operators around the world do in terms of mobile substitution and falling voice revenue, Kaplan says. “It’s tough because Telkom has a cost base it can’t manipulate with ease and an income stream that’s going down.”

Perhaps Telkom’s greatest obstacle is its reputation. “Even with a good strategy and good products, there seems to be a big perception that Telkom is terrible,” he says. “Even if Telkom manages a turnaround with good products and strategy, this is going to hinder them.”

World Wide Worx MD, researcher and analyst Arthur Goldstuck, says it “seems fairly obvious” to him that the recent gains in Telkom’s share price are “a vote of confidence” in the new leadership team and structure. A strong CEO in Maseko, with a “credible, proven and successful right-hand man” in chief operating officer Brian Armstrong, has warmed investors to the share again.

“Whenever you see criticism of Telkom, it tends to focus on the consumer side, while the commentary on Telkom Business seems to be pretty uniformly positive, and that’s thanks to strong leadership from Armstrong,” Goldstuck says. “Another element, I think, is a growing view of what an asset Telkom’s infrastructure is.” — (c) 2013 NewsCentral Media