Since the creation of bitcoin in 2009, blockchain technologies and, in turn, cryptocurrencies have seen enormous growth. Even with the recent pullback in bitcoin, it has still amassed a 209 000% return on investment in 10 years, crowning it the best performing investment asset of the last decade.

Since the creation of bitcoin in 2009, blockchain technologies and, in turn, cryptocurrencies have seen enormous growth. Even with the recent pullback in bitcoin, it has still amassed a 209 000% return on investment in 10 years, crowning it the best performing investment asset of the last decade.

While there are always sceptics to a new technology producing eye-watering returns, one thing has become ever more apparent over the years: It’s becoming increasingly hard to deny cryptocurrencies’ place in a world of excessive money printing and digitisation.

Blockchain, which is the core technology powering cryptocurrencies, is one of the innovations paving the way into the fourth Industrial Revolution (4IR). It has allowed people to build self-executing programs called smart decentralised applications that run without the direct supervision or control of any person or company.

Much like the Internet in its early days, the number of use cases that stem from the use of blockchains and decentralised applications is endless. It’s only a matter of time before we start seeing decentralised applications in our daily lives solving real-world problems.

The source of returns

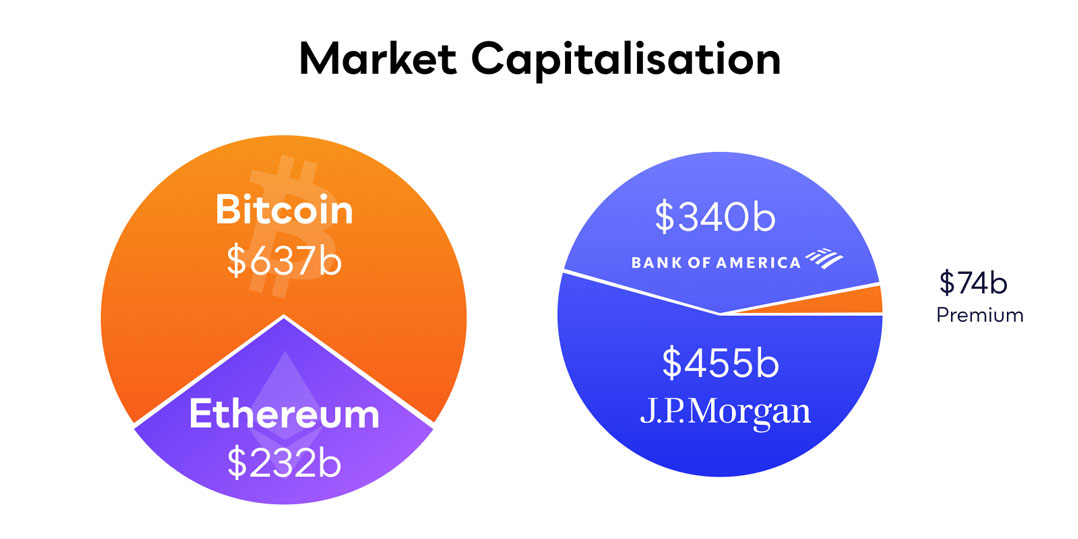

Over the past two years, the size of the cryptocurrency market has grown from US$313-billion to over $1.16-trillion (271% growth). Of this, bitcoin makes up just over $637-billion and ether, the token on the Ethereum blockchain, just over $232-billion, making bitcoin and ether larger than the world’s two biggest banks, JP Morgan Chase and Bank of America, combined.

Although bitcoin grabs all the headlines, it’s the alternative cryptocurrencies, known as altcoins, that have been amassing even more impressive returns.

Although bitcoin grabs all the headlines, it’s the alternative cryptocurrencies, known as altcoins, that have been amassing even more impressive returns.

The total cryptocurrency market size (excluding bitcoin) has grown 418% in the past two years (versus bitcoin’s 322%). This shows that altcoins are driving growth in the overall cryptocurrency market. This is partly due to the rise in various cryptocurrency subsectors, including decentralised finance (DeFi) and non-fungible tokens (NFTs).

DeFi is a subsector of the cryptocurrency industry challenging traditional financial institutions, including banks, insurance companies and stockbrokers, where entrepreneurs build semi-automated trading and lending systems atop blockchain networks.

An NFT is a digital asset that represents real-world objects like art, music, in-game items and videos. They are bought and sold online, and their legal ownership is often recorded on a blockchain.

“Looking at the numbers, the impact on a macro scale is incredible; now imagine the positive impact that this can have in your portfolio if you decide to start investing in cryptocurrencies and diversifying”, says Sean Sanders, founder and CEO of the investment platform Revix.

Closer look at the growth

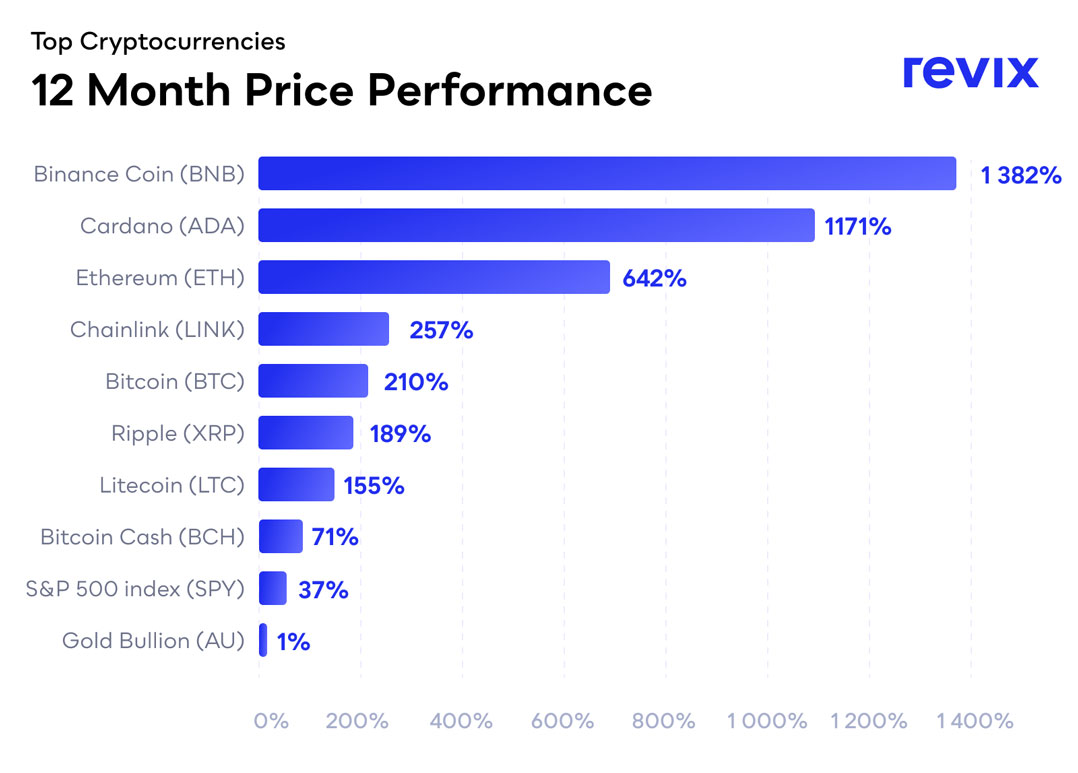

Over the past 12 months, binance coin (+1 382%), cardano (+1 171%), ether (+641%) and chainlink (+257%) have generated astonishing returns when compared to traditional asset classes like the S&P 500 (+37%) and gold (+1%). The broader crypto market’s gains have largely driven these cryptocurrencies over the last year.

With this growth, the total number of cryptocurrencies in existence has increased to over 4 500 in less than 12 years of cryptos’ existence. To put this into perspective, there are only 335 listed stocks on the JSE, and that number is steadily decreasing. This vast number of cryptocurrency options makes it increasingly difficult for investors to scan the investable universe for winners.

How do I pick a winner?

At a glance, the cryptocurrency market can be an overwhelming place, especially for those not well versed in it. Much like the Internet boom of the early 2000s, thousands of blockchain-based projects are being developed, and loads of confusing jargon and technical slang are being shared far and wide.

This makes it nearly impossible to pick the next Amazon.com or Google of the cryptocurrency world and, tougher yet, hold onto them for a sustained period of time.

“Due to the dynamic, high-risk and fast-evolving nature of the cryptocurrency market, we believe that the best way to invest in this asset class is through a well-diversified basket that contains the world’s top cryptocurrencies,” says Sanders.

“Our baskets, or Bundles as we call them, track the majority of the crypto market through a single investment and also contain the most reputable cryptocurrency projects with sustained long-term growth potential.”

One way to lower your risk when investing in the cryptocurrency space is to own a diversified basket of the top 10 cryptocurrencies, which then gets automatically updated every month. The top 10 cryptocurrencies (excluding stablecoins) account for 80% of the total cryptocurrency market capitalisation, so you’ll track the broader growth in the crypto market and not be heavily dragged down by any individual cryptocurrencies.

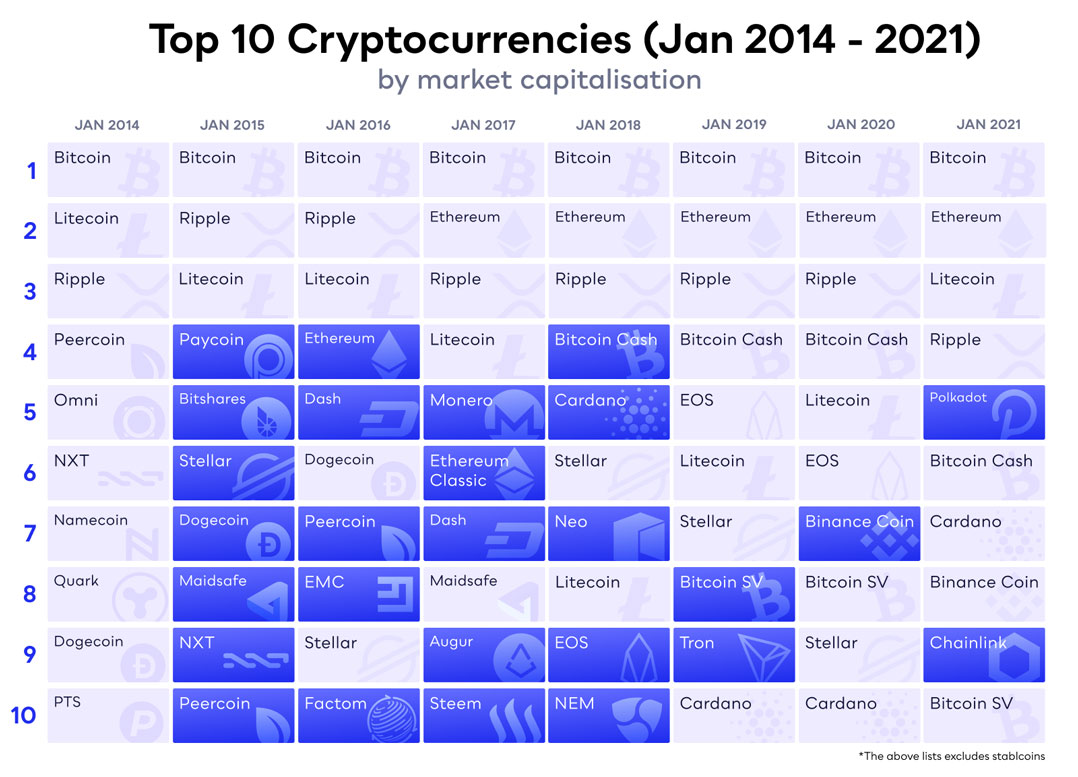

Another factor to consider is how much the top 10 has changed over time.

In the past five years, only four cryptocurrencies have managed to stay among the top 10 largest cryptocurrencies: bitcoin, ether, ripple and litecoin, and only one was able to significantly grow its market share (ether, from 11.31% to 17.36%).

In the past five years, only four cryptocurrencies have managed to stay among the top 10 largest cryptocurrencies: bitcoin, ether, ripple and litecoin, and only one was able to significantly grow its market share (ether, from 11.31% to 17.36%).

A prudent investor should seek an investment product that helps capture these changes and thus keeps the investor well diversified across the crypto universe.

The solution: The Revix Top 10 Bundle

While cryptocurrencies may not be well suited for every investor, early adopters and future-focused investors have been handsomely rewarded for investing in the cryptocurrency market through Revix’s Top 10 crypto Bundle.

In fact, an investment in Revix’s Top 10 Bundle would have outperformed an investment in bitcoin alone by over three times over the last two years, and this return would have come with less risk as your crypto investment would be spread across the 10 largest cryptocurrencies instead of just one cryptocurrency.

The Revix Top 10 Bundle is like the JSE Top40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 80% of the crypto market.

Diversification works in every asset class in the world. It should come as no surprise that it works in crypto as well.

Revix’s Top 10 Bundle enables you to effortlessly invest in the 10 largest cryptocurrencies at a low cost through a single investment. Your crypto Bundle is then automatically rebalanced each month, keeping you up to date with the fast-moving market without you having to lift a finger. This ensures that investors always hold the most prevalent and reputable cryptocurrencies that represent the broader market. And what’s great is that you can sell out of your investment at any time after purchasing it, so you’re not locked in an investment if you don’t want to be.

Sanders says: “We see bitcoin continuing to lose significant market share over the next few years with sectors such as DeFi continuing to show substantial growth into the future driving the value of other projects higher relative to bitcoin.”

As mentioned, the sources of top-performing returns have been generated by alternative cryptocurrencies, including cardano, polkadot, chainlink and binance coin — all cryptocurrencies in Revix’s Top 10 Bundle. Revix believes it is prudent for you to capture these returns better to enhance your portfolio returns.

“With the recent pullback in the crypto market, we believe this is an opportune time to get into the asset class of the future. You know what they say about a dip: Make your move!”

“With the recent pullback in the crypto market, we believe this is an opportune time to get into the asset class of the future. You know what they say about a dip: Make your move!”

Sign up today at Revix using the promocode “MOVE” and get R100 worth of bitcoin deposited straight into your account after your first successful investment. Do not be left behind: Invest in a Bundle today. T&Cs apply.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time. For more information, visit Revix.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience and investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned