In the age of the pandemic, for retail companies that have dragged their feet rather than sprinting toward digital transformation, it may already be too late. As “retail futurist” Doug Stephens explains, in response to the restrictions on movement forced upon the market by Covid-19 – lockdown, social distancing, quarantine, self-isolation – “consumers go looking for alternatives to get them through the short term, but those alternatives may change their behaviour over the long term.”

The South African retail market, previously slow to digitalise, has by necessity reached a watershed of disruption.

Research conducted in February by Coresight and reported by Business Insider indicated that 74.6% of US internet users would avoid malls and shopping centres if the outbreak worsened, and 52.7% would avoid physical stores entirely.

Read: Retail innovation in the time of Covid-19

There is no guarantee that post-Covid – once a vaccine, a cure or at least a reliable serology test can definitively mark individuals as “safe” – consumers will flock back to brick-and-mortar stores. Once they develop a taste for the ease of e-commerce, customers are unlikely to revert to old, less convenient habits.

The home delivery revolution that Covid has thrust upon South African society is unlikely to go away. Investec’s Focus podcast puts it pretty succinctly: “Go big, or go online.”

To survive this period of disruption, companies will need to lean smarter. Increasing homogeneity of pricing means the winners in this race will be those that find other ways to differentiate themselves. Technology solutions, such as leveraging data and AI to track inventory and proactively replenish fast-moving stock, can help retailers manage their buying processes and supply chain and ensure no customer ever need face the disappointment of a much-needed item being out of stock.

Single view

Meanwhile, cloud technology monitoring customer interaction with e-commerce platforms provides a single view of products from buying to delivery, ensuring speedier shipping and delivery. Applying technology and innovative thinking to such challenges helps drive a better, seamless shopping experience for customers — and hence greater retention and repeat purchasing.

Globally, those companies that have focused for the last decade on innovation, especially on adapting from bricks-and-mortar to e-commerce, or to a combination of the two, are surviving the pandemic far better than those that have not. Yet, Blake Morgan of Forbes says what while “70% of companies had a digital transformation in place or were working on one … most companies were not far enough along to make Covid-19 a non-issue”.

In South Africa, one of the most concentrated retail markets in the world, 85% of mall space is rented to the handful of large corporates that dominate the landscape. Yet less than 2% of these traditional retailers’ business is done online and, pre-Covid, most of them would have forecast this to increase to around 5% by 2025.

In South Africa, one of the most concentrated retail markets in the world, 85% of mall space is rented to the handful of large corporates that dominate the landscape. Yet less than 2% of these traditional retailers’ business is done online and, pre-Covid, most of them would have forecast this to increase to around 5% by 2025.

Not every business can suddenly achieve the footprint and market share of a Takealot, which in its current incarnation has had a 10-year head-start, not to mention the power of Naspers behind it. Retailers seeking to jumpstart their online profitability should look to operational drivers like automation, AI and XaaS to save costs, digitalise their business and provide a seamless customer experience.

So, how can innovation, especially e-commerce, see South African businesses through this undeniably critical period?

Partnerships

- Pick n Pay and Bottles (which, under lockdown levels 4 and 5, has been unable to practise its core business of online liquor sales): The long-established grocery retailer has leveraged the agility and distribution/logistics capabilities of the online platform to increase its e-commerce and home delivery capacity.

Adaptability

- NetFlorist recognised that flower sales were unlikely to be classed as an essential service and quickly added food deliveries to its offerings.

- Cape Union Mart announced it would be working with suppliers to manufacture and supply face masks and other personal protective equipment.

Differentiation

- Shoprite’s new Checkers Sixty60 app – “The Uber of food” – differs from other grocery apps in that it guarantees delivery of orders within 60 minutes. On 12 May, Sixty60’s ultra-quick delivery was available from nine branches; by 25 May that number had risen to 26 across three provinces.

Acknowledging and serving the lower tier of South Africa’s two-tier economy

Pepkor has solved for a number of systems issues that might otherwise have been stumbling blocks to successful e-commerce in the country’s unusual economy:

- Delivery: Solutions in place for delivering to customers who may not have a formal address.

- Cashless nature of e-commerce: The unbanked are able to take advantage of Pepkor’s online offerings by buying Flash vouchers, which can be used for online purchases, for cash at till points in spaza shops.

- Buying for others not within one’s immediate household: PAXI is an alternative to the Post Office in which branches of Pepkor retailers such as PEP and Ackermans also function as delivery depots.

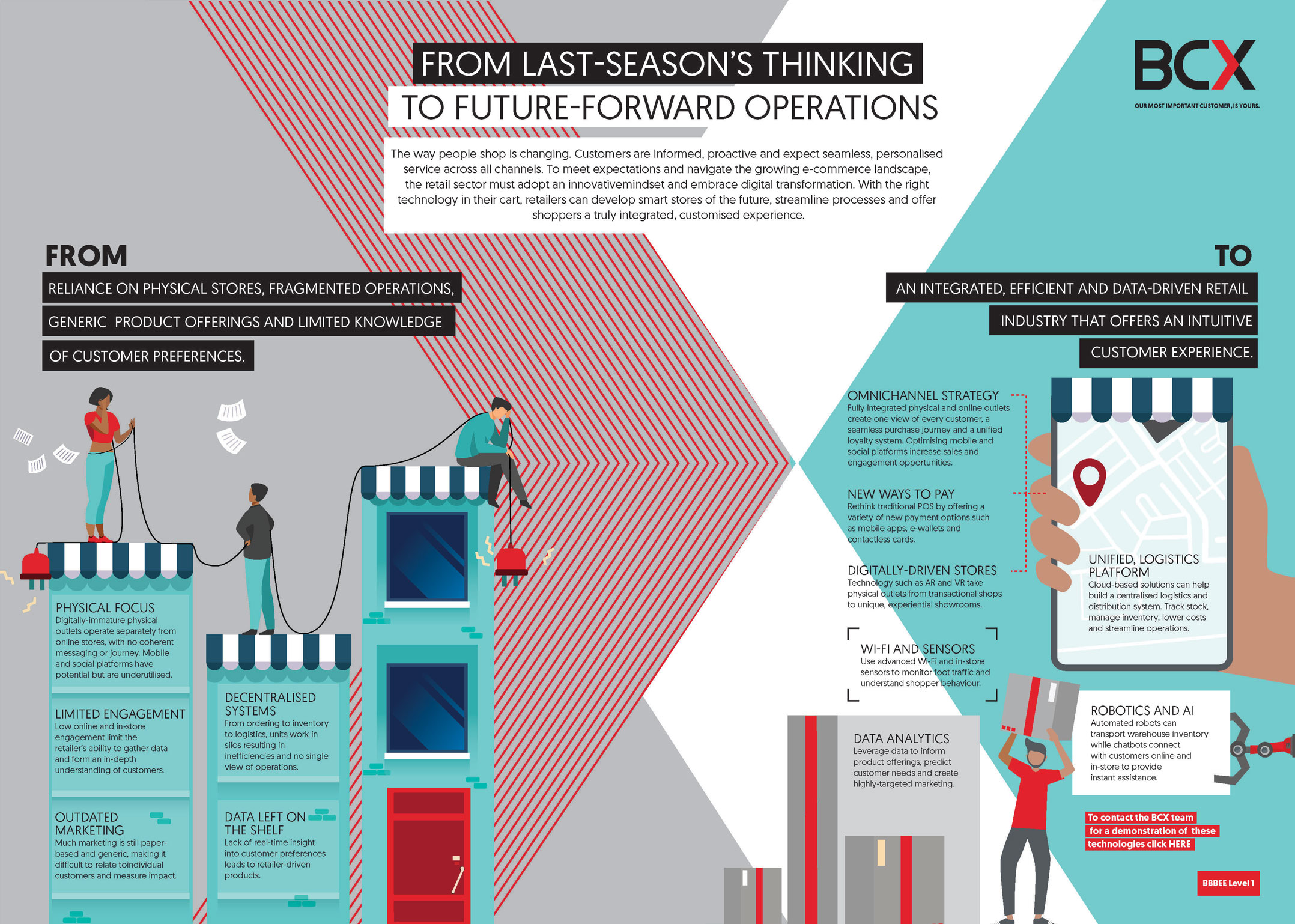

Find out how technology and innovation can streamline your business and provide frictionless shopping experiences for your customers.

About BCX

At BCX we consider ourselves your partners, and we take care of your technology so that you can focus on your customers’ needs. The goal of every member of our team of over 6 000 people is to maximise your productivity, increase your profits, and most of all, future-proof your business.

BCX offers a complete service in ICT. We take care of your technology so that your workforce is free to focus on your customers’ needs, build productivity, grow profits and embark on the journey to digital transformation.

Our track record of reliability, stability and consistency speaks for itself. Before Telkom’s acquisition of the company in 2015, Business Connexion had been running since 1996, when it was founded by 23-year-old twin brothers Benjamin and Isaac Mophatlane. The company was listed on the JSE in 2004, after a merger with Comparex Africa. Today we work with businesses from tiny start-ups to JSE-listed enterprises and international corporations.

For more information, contact us on +27 (0) 21 550 3000.

- This promoted content was paid for by the party concerned