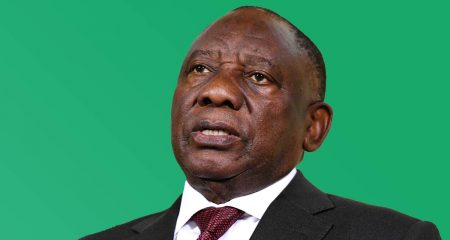

Faced with the biggest challenge of any post-apartheid South African leader, President Cyril Ramaphosa has also been given a rare opportunity to push through the painful reforms the economy needs.

The twin crises of the coronavirus pandemic and the country losing the last investment-grade rating on its debt have silenced his critics, both within his party and the opposition. It’s also allowed him to project the statesmanship for which he was famed when he negotiated the end of white-minority rule more than a quarter of a century ago.

After two years of criticism for a slow response to the country’s deepening economic crisis and delays in implementing key policy reforms, Ramaphosa’s swift reaction to the pandemic has been praised. South Africa beat worse-hit countries in Europe and North America in closing schools and bars and then imposing a lockdown. The president has come across as compassionate and decisive in a series of national addresses and has demonstrated an ability to work with both labour unions and business.

“The president has stepped up to the plate here in an extraordinary way,” said Martin Kingston, vice president of Business Unity South Africa, the country’s biggest corporate lobby group. “Crisis creates a furnace in which we are forging extraordinary partnerships.”

In seemingly taking to heart Winston Churchill’s saying “never let a good crisis go to waste”, the government has already used the cover of the economic fallout of the virus to tackle one of its biggest problems. On 18 March it said it would renege on a costly agreement to raise pay for most of the country’s 1.3 million civil servants by more than inflation and would instead leave their wages unchanged.

“It gives them a window to march through certain things that they can package as part of the health crisis,” said Ralph Mathekga, an analyst and author of books on South African politics. “You can rationalise expenditure severely. As long as the president is seen as protecting the nation, he will prevail.”

IMF funding

On 29 March, two days after Moody’s Investors Service cut the country’s debt to junk, key allies of Ramaphosa — finance minister Tito Mboweni and Reserve Bank governor Lesetja Kganyago — said the economic crisis was an opportunity to fix the economy. Mboweni said South Africa may seek funding from the International Monetary Fund for the first time, ignoring the ANC’s previous ideological opposition to taking money from the institution.

“We have no room to be emotional about certain things,” said Thabi Leoka, an independent economist in Johannesburg. “We simply do not have the funds for both recovery in the country and dealing with the effect of the coronavirus.”

A near-decade of graft-ridden rule by Ramaphosa’s predecessor, Jacob Zuma, has left South Africa with surging debt, regular power outages and state companies surviving on bailouts.

“Throwing more money into the economy is insufficient and unsustainable,” deputy finance minister David Masondo said on a conference call convened by Mboweni. “We need to move with structural reforms.”

For now, the markets have little faith in Ramaphosa’s ability to rescue an economy that his ANC has mismanaged by tolerating corruption and failing to take decisions on matters as simple as the sale of broadband spectrum and streamlining a visa regime that deters skilled foreign workers and tourists. ANC spokesman Pule Mabe didn’t answer calls to his mobile phone.

On 30 March, the first opportunity to trade after the Moody’s decision, the rand fell to a record low and yields on 10-year government bonds opened 60 basis points higher.

Still, the depth of the crisis has left little room for Ramaphosa’s critics to be heard.

“There is no question that pressure has substantially disappeared. The president needs to jump on it,” said Iraj Abedian, CEO of Pan African Investment & Research Services. “There is literally nobody in the anti-Ramaphosa camp that can offer anything.”

Still, while being praised for his performance in recent weeks, Ramaphosa will need to abandon his habit of consulting widely before every decision and trying and appease all factions within the ANC.

“There’s no more time for freeloaders. Now, we need to save and cut all inefficiencies. It’s going to be painful,” said Sasfin Securities deputy chairman David Shapiro, who has been trading stocks in South Africa since 1972. “We’ve been calling for this for a long time but nobody has had the courage or stomach to do it. Maybe this is going to change all that.” — Reported by Antony Sguazzin and Prinesha Naidoo, (c) 2020 Bloomberg LP