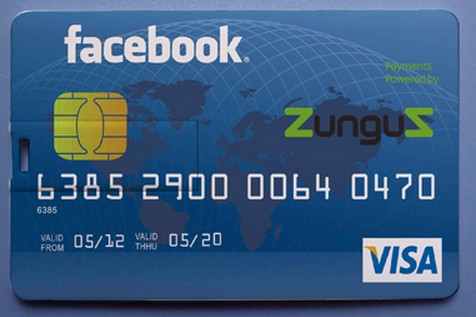

Cape Town-based Facebook payments facilitator ZunguZ is expanding its offering to include debit cards, allowing its users to make purchases anywhere Visa cards are accepted.

The Facebook-branded cards will be free to users and will be made available within the next six months and have the backing of the US-headquartered social network.

Launched last year, ZunguZ allows Facebook users to send money to and receive money from their Facebook contacts. The service recently added the ability to take out micro loans using partner GetBucks.

Over the next six months, all existing ZunguZ account holders will get debit cards couriered to them. They can be used online or at physical merchants, with no fees for day-to-day transactions except cash withdrawals at an ATM.

ZunguZ co-CEO Rob Sussman says the company has ordered an initial batch of 40 000 cards and will place further orders, depending on demand.

Beyond supplying the cards to its customers, the company also plans to make them available in retailers such as Shoprite and Incredible Connection.

Sussman says this makes the ZunguZ debit card an option for the unbanked or infrequent bank users, adds functionality to ZunguZ’s existing services, makes it possible to withdraw cash from ATMs, and allows the cards to serve as gift cards that aren’t tied to particular malls or stores.

“It’s also great for the teen market,” he says. “For some it could be their first-ever banking product. It’s quite attractive to the tech-savvy youth market because Facebook has such strong brand recognition with them.”

If a customer gets a card from a retail outlet, they will be able to activate a ZunguZ account on Facebook and set up a PIN for the card in minutes using the social network.

Sussman explains the service mitigates the risk of giving out banking details online. “Your ZunguZ account is not linked to your actual bank account. Your exposure to fraud or theft is limited by the amount of money in your ZunguZ account. For this reason, it’s a great way to shop online.”

Various checks and measures exist to ensure consumers can’t create fake accounts or otherwise abuse the ZunguZ system. Before allowing transfers between Facebook users, the service vets customers digitally. It automatically reviews new sign-ups and considers how long they’ve been on Facebook, how many friends they have and what sort of interactions exist between them. Through this analysis, ZunguZ is able to determine whether an account if genuine or not.

Users who have supplied only their mobile phone number can store R3 000 in a ZunguZ account. If they provide a copy of their ID book, they can store or move larger sums. Users can have a maximum of R20 000 stored.

The debit cards will work like all chip-and-PIN Visa cards. New users will be able to pick up a card from a retailer and set their PIN online when they activate a ZunguZ account.

Retailers are interested in the social media possibilities the card presents, Sussman says. “Users can become brand ambassadors for the brands they like,” he explains. “For example, you could allow ZunguZ to post a Facebook status update when you buy something at your local coffee shop, either because you like the brand, or in case other friends are in the area.” — (c) 2012 NewsCentral Media