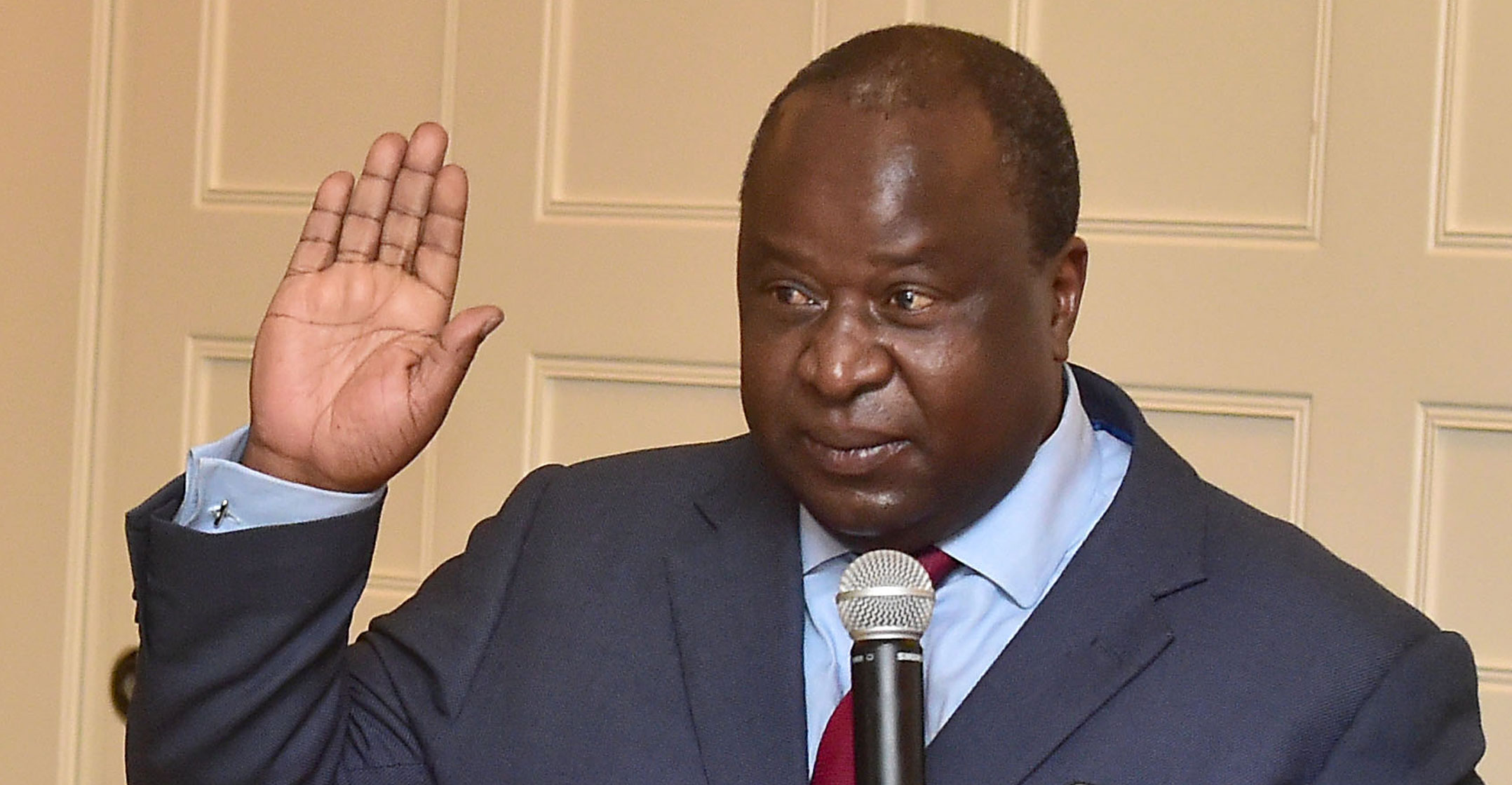

South Africa must cut spending to avoid a sovereign debt crisis within the next four years, finance minister Tito Mboweni has warned.

Mboweni is preparing to deliver a revised budget on 24 June that will reflect the devastation wrought on the economy by the coronavirus pandemic, he told MPs on Thursday in Cape Town. National treasury plans to make “very serious and unusual changes” to its expenditure plans, he said.

“We can no longer spend the way we were spending before,” he said. “A sovereign-debt crisis is a very serious matter and we are looking it in the eye by 2024 if we do not redo our budget, if we do not manage our house finances carefully.”

The adjustment budget Mboweni is preparing will redirect R130-billion in the R500-billion coronavirus stimulus package President Cyril Ramaphosa announced in April. The fiscal deficit is likely to be double the 6.8% of GDP he projected in February, and forecasts for government debt could be close to 80% of GDP.

Revenue collection in South Africa has been undershooting estimates for at least five years. A nationwide lockdown that began in March to curb the spread of the virus is likely to further weigh on tax income, with many businesses forced to shut down permanently. That means the government won’t be able to spend more to boost an economy that the central bank projects will contract by 7% this year.

Zero-based budgeting

Mboweni said the government must consider adopting a zero-based budgeting system, in which funds are allocated according to the state’s revenue base. Ramaphosa backed the proposal in a separate speech to MPs on Thursday, when he said such an approach would become “the new normal”.

“We are no longer as rich as we thought we were,” Mboweni said. “We are much, much poorer and therefore all of us have to adjust our expectations.”

A debt crisis would force the nation to seek help from the International Monetary Fund, which would result in the public service and state pensions being slashed, along with “all kinds of structural reform programmes we do not want,” he said. — Reported by Paul Vecchiatto, (c) 2020 Bloomberg LP