Public net sentiment towards Absa has jumped in the past year, an analysis of hundreds of thousands of social media conversations shows. FNB remains the banking sector’s laggard.

Public net sentiment towards Absa has jumped in the past year, an analysis of hundreds of thousands of social media conversations shows. FNB remains the banking sector’s laggard.

The latest BrandsEye’s South African Banking Sentiment Index, now in its sixth year, reveals which banks are faring well, and which are not, by tracking conversations among social media users.

For this year’s report, BrandsEye collected over 2.7 million consumer social media posts about South African banks between 1 September 2020 and 31 August 2021.

About half a million of these posts were analysed for sentiment and conversation themes, including the “treating customers fairly” (TCF) outcomes prescribed by the Financial Sector Conduct Authority.

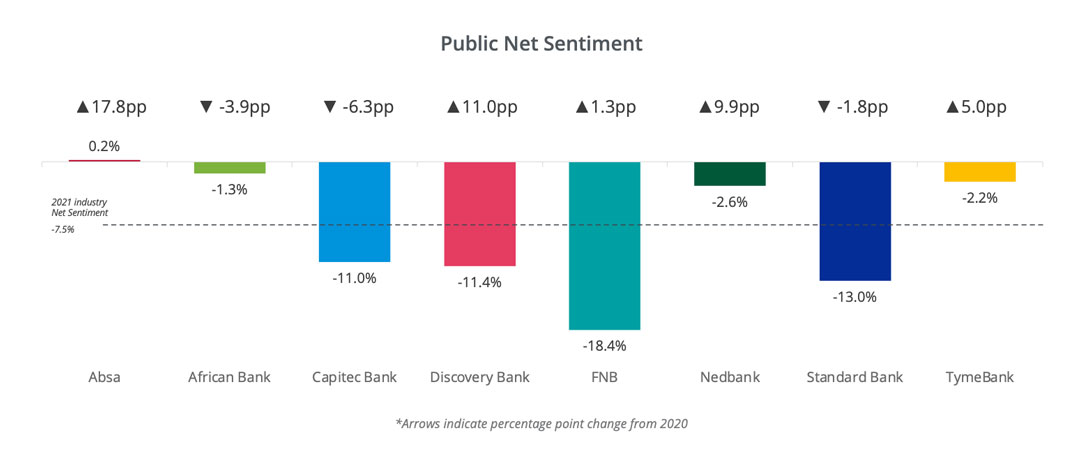

“Overall, the banking industry still experienced more negative conversation on social media than positive — resulting in an industry net sentiment of -7.5% — but it seems to be headed in the right direction, having improved in net sentiment for a second consecutive year,” BrandsEye said.

Absa showed the greatest improvement in overall public net sentiment in the latest report, having climbed the ranks both operationally and reputationally to take first place in the index.

“The biggest improvement in terms of size, however, was Discovery Bank’s operational improvement of 23.9 percentage points, which saw it move up from eighth last year to sixth this year,” BrandsEye said.

Methodology

Public net sentiment is the overall customer satisfaction metric, calculated by subtracting all negative sentiment from positive sentiment. Operational conversation refers specifically to feedback about the customers’ experience of business operations, whereas reputational conversation includes online press coverage, owned and earned PR and marketing efforts, and publicity generated by social responsibility efforts.

In terms of reputational sentiment, TymeBank scored the most positively by a large margin. “The digital bank leveraged social media influencers as brand ambassadors to drive positive content, boosting reputational sentiment by 3.8 percentage points and securing third place overall in the 2021 index rankings.”

Banking customers posted 188 649 “priority” Twitter posts in the past year. That’s 28% growth in service conversations — 38% when including risk mentions — and “speaks to an increasing demand for social media customer service across the industry”.

“However, considering that many of these mentions (57%) went unanswered, South African banks still have a way to go in meeting the growing social media service demands of customers,” said BrandsEye business development director Lyndsey Duff.

“However, considering that many of these mentions (57%) went unanswered, South African banks still have a way to go in meeting the growing social media service demands of customers,” said BrandsEye business development director Lyndsey Duff.

“Banks have yet to effectively handle the growing volume of service requests on social media. Service-related conversation first spiked in 2020 as a result of Covid-19 but has continued to increase throughout 2021.” — © 2021 NewsCentral Media