South Africa’s mobile operators, including Vodacom, MTN and Rain, are set to face a big challenge to their business models from an unexpected quarter: fixed-line broadband.

South Africa’s mobile operators, including Vodacom, MTN and Rain, are set to face a big challenge to their business models from an unexpected quarter: fixed-line broadband.

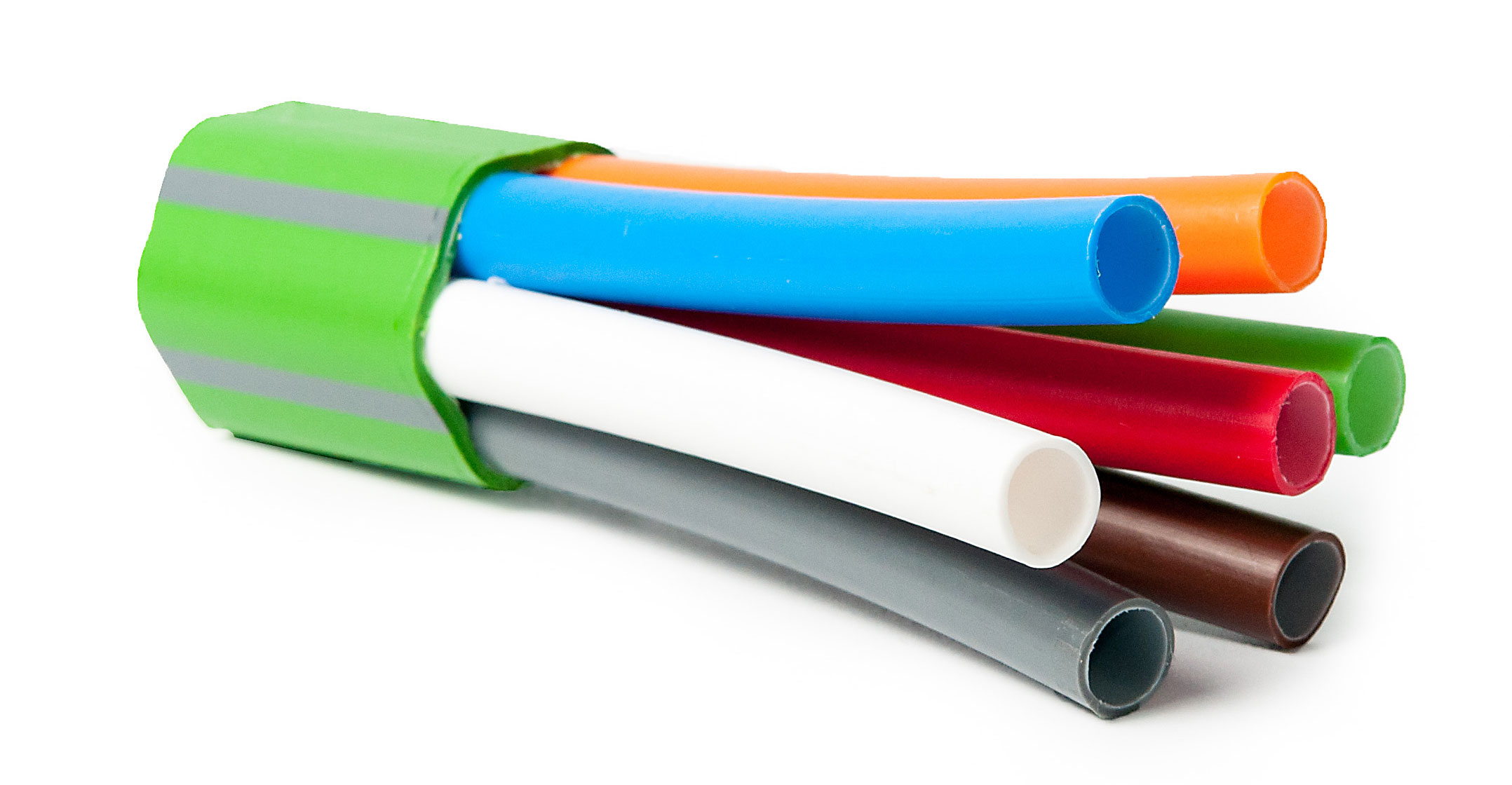

This statement may seem almost counterintuitive. For at least the past decade, the opposite has been true: Consumers have been ditching fixed lines, especially Telkom’s legacy copper cables that provide (now hopelessly slow) ADSL Internet into people’s homes, in favour of fixed-line fibre where it’s available, but they’re also opting for home 4G/LTE delivered over mobile infrastructure.

In townships and other areas not yet served by fibre providers like Vumatel, Openserve and Frogfoot Networks, LTE has become a popular choice for home access. Alternatively, consumers simply use mobile data bundles or expensive ad hoc prepaid data on their smartphones to connect – an expensive option, especially if one consumes a lot of multimedia content online (Netflix, YouTube, music streaming, etc).

The uptake of fibre services across South Africa in recent years has been nothing short of spectacular. Kick-started by the risk takers behind Vumatel (Niel Schoeman and Johan Pretorius), fibre is now almost ubiquitous across the well-to-do parts of cities such as Johannesburg and Cape Town and is increasingly making its way into smaller cities and towns and into traditionally underserved areas in townships like Soweto.

Billions in investment

News that Vumatel parent CIVH has raised R3.7-billion in a second tranche of a rights offer (bringing the total raised from shareholders in just six months to R6.7-billion) shows that CIVH and its biggest investor, Remgro, are taking the home fixed-fibre opportunity very seriously indeed. The offer, which was oversubscribed, comes as Vumatel expands its network, including bringing coverage to areas never served by fixed lines, driven by an explosion in demand for uncapped Internet as people increasingly work at home and go online to educate and entertain themselves.

The second tranche of the rights offer, which was oversubscribed, has placed a valuation on CIVH, which also owns Dark Fibre Africa, of R27-billion – several billion rand more than Telkom, which once enjoyed a total monopoly in South Africa’s telecommunications industry. Indeed, it was tardiness by Telkom in rolling out home fibre – preferring instead to sweat its ageing copper assets – that provided the space for Vumatel and others, like Vox-owned Frogfoot, to emerge as strong contenders in the home fixed-line market.

Remarks made by Pieter Uys, head of strategic investments at Remgro and chairman of the board of Vumatel parent CIVH, in an interview with TechCentral on Monday demonstrate clearly that not only do investors see home fibre as a strong growth industry for years to come, but it will increasingly challenge mobile operators, and not only fixed-line infrastructure providers like Telkom, for share of consumers’ wallets.

“A lot of demand is coming from residential areas where you would not expect it, like Soweto,” Uys said. “Uptake in those areas is twice as fast as it is in Sandton. If Sandton takes two years to reach 50% penetration (homes connected where service is available), Soweto or Vosloorus will achieve the same penetration in 12 months.”

“A lot of demand is coming from residential areas where you would not expect it, like Soweto,” Uys said. “Uptake in those areas is twice as fast as it is in Sandton. If Sandton takes two years to reach 50% penetration (homes connected where service is available), Soweto or Vosloorus will achieve the same penetration in 12 months.”

That’s amazing! Many industry players had assumed that, given the cost of deploying fibre, it would never be commercially viable to expand it beyond the leafy suburbs of South Africa’s big cities. Vumatel, Frogfoot and others are now disproving that assumption and are demonstrating that demand for uncapped fibre is universal – and should be profitable, too.

Vumatel’s Reach product, which it is deploying mainly in underserved areas on the periphery of South Africa’s major urban areas, costs R399/month for uncapped, prepaid 20Mbit/s (symmetric) fibre. Not surprisingly, it’s proving to be hugely popular, according to Uys. Instead of relying on expensive mobile data, consumers in these areas are rushing to sign up to uncapped fibre that allows them to use the Internet as it’s meant to be used – without fear of hitting a data cap or incurring out-of-bundle charges.

“There is pent-up demand and our ambition is to make a difference. We really think we can democratise the Internet in South Africa,” said Uys, who is a former group CEO of Vodacom. Mobile data will continue to play a big role, of course, especially in areas where fibre simply will never be deployed, like the rural Eastern Cape or on farms in the Karoo. Here, mobile will continue to be the primary way people connect, though satellite solutions have also improved dramatically in recent years and become cheaper.

Biggest pressure

But it’s in the urban areas, like Soweto and Mamelodi and Vosloorus, where the mobile networks could feel the biggest pressure from the aggressive push by Vumatel, Frogfoot and others into these areas. And if they have uncapped fibre at home, consumers will use less mobile data — probably much less! Companies like Vodacom and MTN will have to cut their data prices (more than they already have) to remain competitive. And even then, they’ll struggle to provide similarly priced uncapped services given the spectrum constraints they still face – and may continue to face even after communications regulator Icasa eventually completes its long-delayed auction of 4G- and 5G-suitable spectrum.

If Uys and the teams at Vumatel, CIVH and Remgro are right, fixed lines are far from dead — they’re about to stage a big and unexpected comeback. — © 2021 NewsCentral Media

- Duncan McLeod is editor of TechCentral. Follow him on Twitter