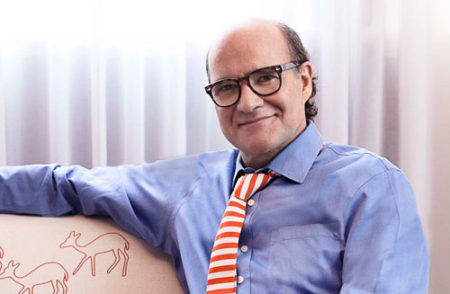

RainFin hopes to disrupt SA’s financial services sector by allowing credit-worthy South Africans to engage in person-to-person lending, cutting out banks in the process and offering higher returns to lenders and better interest rates to borrowers. Sean Emery, cofounder and CEO of RainFin

Browsing: FNB

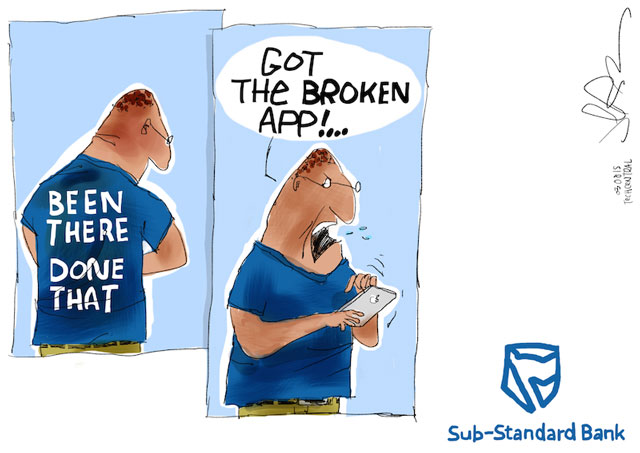

Standard Bank has become the latest SA bank to launch a mobile transactional banking app. The app appeared on Apple’s App Store for iOS devices on Tuesday. Moneyweb, a financial news website, reported on Wednesday that the app was in both the Apple and Google

Nedbank launched its mobile banking application, called the Nedbank App Suite, to its staff on Monday. The bank says it will be available to the public from the beginning of August. The app has taken two years to develop and is only the third in the

When I sit down with Saki Missaikos, the new Internet Solutions (IS) MD, at the canteen at Dimension Data’s sprawling campus in Bryanston, north of Sandton, he immediately takes a shine to my new Samsung Galaxy S3 smartphone. He confesses that he’s moved almost wholesale to Apple

There’s a new personal financial management website in town and it’s upping the stakes in an increasingly competitive market by offering its service completely free of charge. Pastel My Money is free to all users, even if they’re not current Pastel customers. PFM tools have enjoyed prominence in SA in the

First National Bank has extended the functionality of its e-wallet, making it possible for any customer to send money to any SA mobile user using the FNB banking application for mobile devices. Recipients can withdraw the cash, use it to buy prepaid airtime or electricity, send the money to another cellular

Absa on Tuesday released a beta version of its new online banking portal that includes the first steps into personal financial management software.

The widget-based layout is fully customisable and will become the default digital platform for its clients in months to come. Adrian Vermooten, Absa’s deputy

Absa says it is working on smartphone banking applications in the wake of the launch on Tuesday of its overhauled online banking platform. It says the new platform, which took two years to develop, is a necessary step to launching dedicated banking apps for mobile devices. Adrian Vermooten, Absa’s deputy managing

22seven is no longer in beta. It will offer users a 30-day free trial, after which the service will cost R70/month. There is no contractual commitment and users can opt out at any time. CEO Christo Davel says mobile applications are inevitable, but won’t commit to a timeline for their launch

First National Bank has outlined in detail its new geo-payment service Geopay after news of the feature in its smartphone app leaked on Monday. It allows consumers to make payment to anyone nearby them who has a compatible mobile device, even to customers of other banks. Though the initial focus is on person-to-person