OVEX has launched an all-new trading tool for the buying and selling of your favourite cryptocurrencies. The product is soon to be launched on the OVEX platform.

OVEX has launched an all-new trading tool for the buying and selling of your favourite cryptocurrencies. The product is soon to be launched on the OVEX platform.

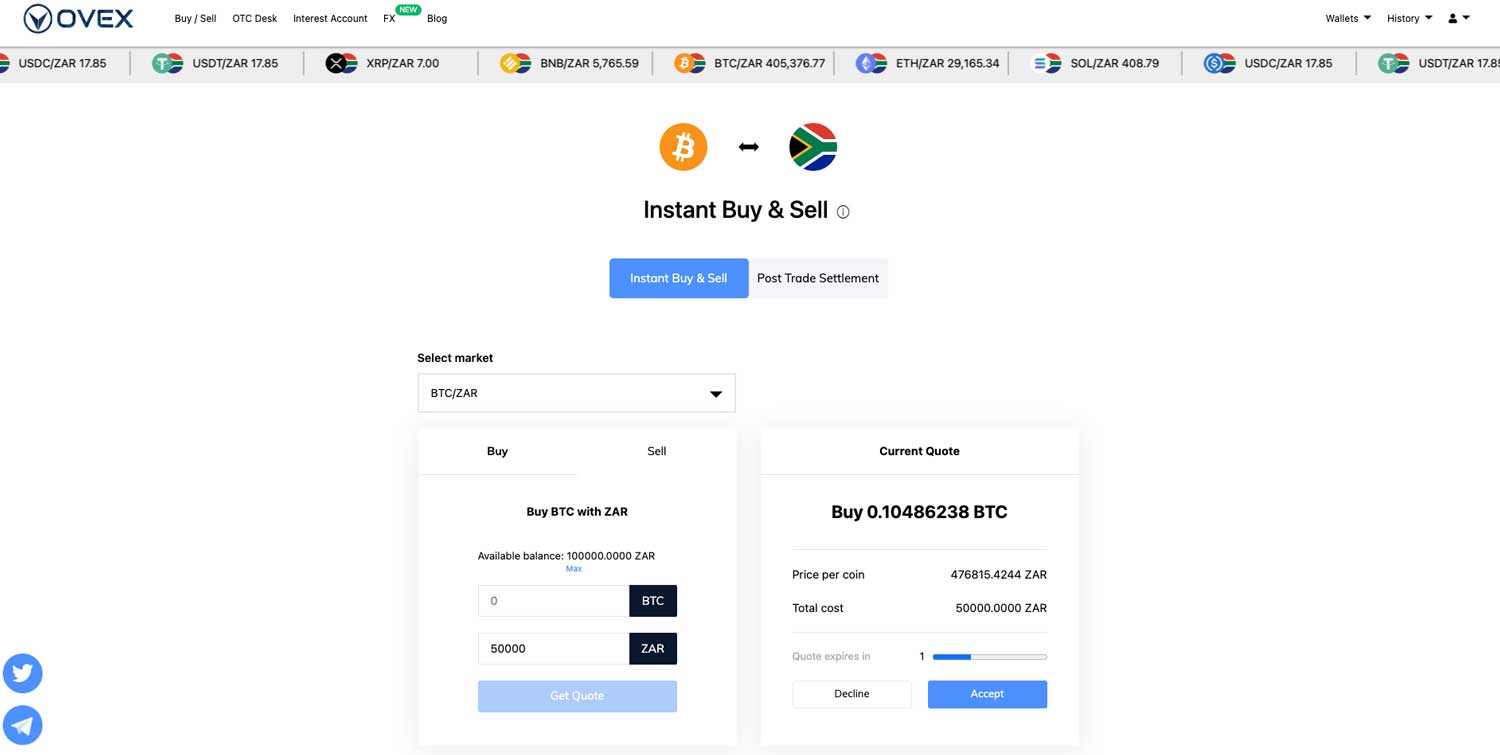

Introducing … OVEX Instant Buy & Sell.

The crypto exchange touts this new product as its institutional-grade trading tech now made available to the everyday OVEX trader.

Instant Buy & Sell lets you browse over 60 different cryptocurrency pairs and then trade them with lightning speed at the simple click of a button.

There’s no need to navigate complicated order books – simply choose your desired pair and trade. The new tool means even first-time crypto investors can trade like the pros.

What’s more – OVEX does not charge any trading fees. This means you are able to trade all of the exchange’s digital assets at fair value.

True (or fair) value is a rate that fairly depicts market dynamics, as opposed to an unfair price that reflects a “liquidity” imbalance on the exchange on which you are trading. Unsure what we mean by “liquidity”? Not to worry, we will touch on that later in this article.

It is commonplace for cryptocurrency exchanges to charge anywhere between 0% and 2% per trade, depending on whether you’re a maker or taker. These terms might be news to you – but they are the makings of an exchange and determine how “liquid” assets traded on the exchange are.

A liquid market is one where you can buy and sell assets easily and at fair value. Exchanges with high levels of liquidity are the most sought after by traders as they offer the best prices and ensure trades, regardless of size, are settled timeously. This is why exchange’s like OVEX are popular among high-value investors – they can trade with peace of mind knowing their orders will be filled on time (and at the best price).

Try out OVEX today

Many exchanges generate a considerable portion of their revenue by charging trading fees for matching users on their order book. This means that any time you create an order and it’s executed, you pay a small amount in fees. But that amount differs from one exchange to the next, and it may also vary depending on your trading size and role.

Your trading size (or volume) impacts the amount you pay as a result of “slippage”. Large trades are aggregated over a number of buyers and/or sellers. This means the execution price ends up as an average of the lot. OVEX, on the other hand, is the only counterparty in every trade made on the exchange (that is why they are known as “market makers”). This means you lock in one single price for any trade – regardless of the volume. This price-lock feature is why the OVEX platform does not offer an open order book.

Your trading role also determines the price you pay. Remember makers and takers? Well the more makers there are, the more trade inventory there is on an exchange – which means the more liquidity there is available. Which translates into better prices.

Deep liquidity

Put simply, makers put down offers at different price levels to buy or sell different assets listed on the exchange. The more “offers” there are, the more entry levels for the other side of these trades to take place, which means the chances of you securing the price you were looking for are high.

Takers, on the other hand, “take” the trade inventory that the makers “make”. Basically, they execute a “market order” – an instruction to buy/sell the asset at the current market price. These takers are charged high fees for removing liquidity from the exchange.

OVEX is unique in that it does not impose maker or taker fees. Instead the exchange itself leverages its deep liquidity to act as the counterparty in every trade and offer its users the best execution price.

Summing it up, makers are the traders that create orders and wait for them to be filled, while takers are the ones that fill someone else’s orders. The key takeaway here is that market makers are the liquidity providers. OVEX is a market maker. The exchange is well known for its deep liquidity which enables it to maintain low and stable prices.

This means regardless of your crypto know-how – with OVEX you can trade like the pros every time. With versatile funding options, the exchange boasts over 16 fiat onramps. To add to its versatile funding options, OVEX also offers an instant deposit function. Safely fund your account in seconds and never miss out on a trade opportunity.

Try out OVEX today.

- Read more articles by OVEX on TechCentral

- This promoted content was paid for by the party concerned