Standard Bank has become the latest SA bank to launch a mobile transactional banking app. The app appeared on Apple’s App Store for iOS devices on Tuesday.

Moneyweb, a financial news website, reported on Wednesday that the app was in both the Apple and Google Android Play stores. TechCentral has established that a version for BlackBerry devices is also available.

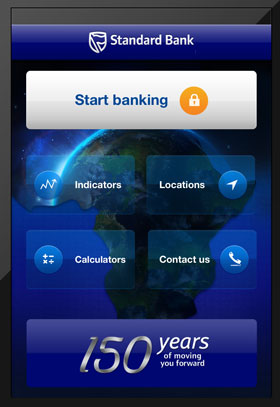

The app offers full transactional banking capabilities as well as financial indicators, calculators and a branch and ATM locater. The Apple version of the app is designed for the iPhone, though it can be also be run on the iPad. A full iPad version is coming soon, a Standard Bank spokesman says.

The app allows Standard Bank clients to link up to 10 supported devices. It also allows users to view available and actual account balances, get graphs that compare the state of their accounts, see net balances on all accounts, search for specific transactions and view provisional, 30-day, 60-day and 90-day statements.

Clients can pay beneficiaries that have been preloaded on their profiles and buy airtime from all of the country’s mobile operators. It also allows clients to send money to any other Standard Bank SA customer using just their mobile number, provided they are registered for the bank’s mobile banking service, or to their bank account number.

There is no subscription fee for the use of the app.

Publication of the Standard Bank app in the Apple and Google stores comes just days after Nedbank launched its mobile banking application, called the Nedbank App Suite, to its staff on Monday. The bank says it will be available to the public from the beginning of August. The app has taken two years to develop.

First National Bank was the first SA bank to launch a dedicated app for banking in July 2011. Sister company Rand Merchant Bank followed suit.

The Nedbank App Suite will be available for devices running Apple’s iOS and Google’s Android operating systems, as well as for BlackBerry devices and the majority of feature phones.

Absa is known to be working on its own mobile banking app, too, though it’s not known when it will be launched commercially. — (c) 2012 NewsCentral Media