Revenue forecasts for communication service providers in the African and Middle East (AME) growth markets remain bleak, with projections of continued stagnation for a minimum of three years.

Revenue forecasts for communication service providers in the African and Middle East (AME) growth markets remain bleak, with projections of continued stagnation for a minimum of three years.

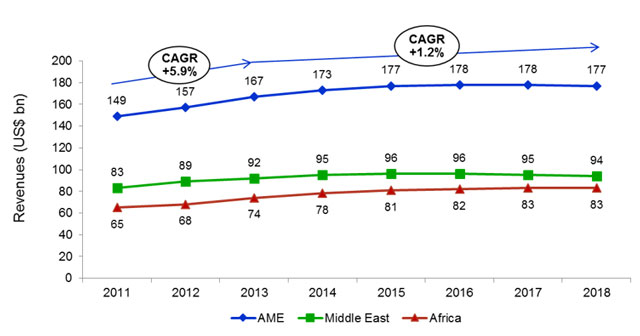

According to Ovum, the AME mobile market will grow from US$167bn in 2013 to just $177bn in 2018, a significant slowing over the previous five years. Underlying this trend is the failure of rising demand for mobile data to offset the declining need for legacy voice and SMS.

To exacerbate the problem, saturation in urban areas has increased the pressure on telecommunications operators to roll out price-competitive consumer products within reduced timeframes, often resulting in unsatisfactory outcomes for both consumer and service provider.

Fixed-line prospects look even more limited, with pressure from free-to-consumer alternatives continuing to affect pricing and top-line growth.

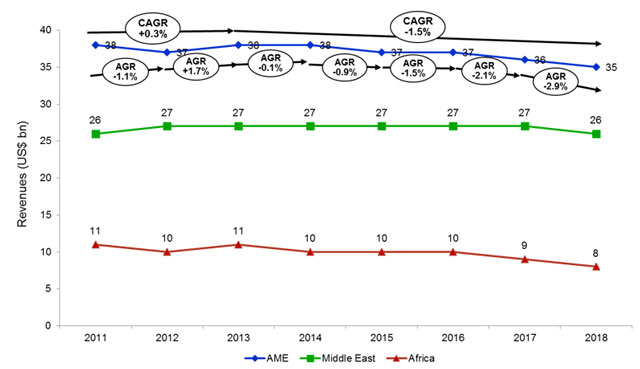

For now, mobile is strong, attracting 78% of total communications spending in AME. By contrast, fixed-line revenue continues to dwindle as a percentage of total spend, posting a negative 1,5% compound annual growth rate (CAGR).

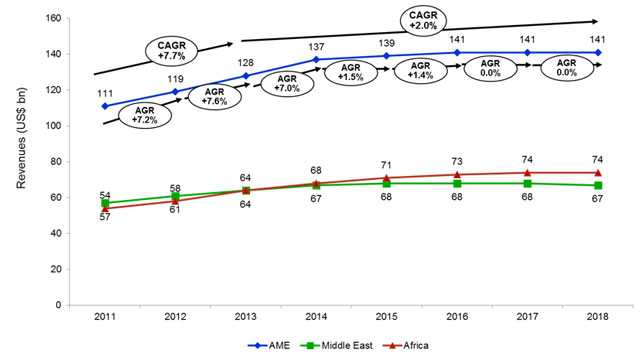

When broken down by product segment, we notice that the influential voice segment is expected to continue to shrink at -0.5% CAGR over the period between 2013 and 2018, while non-voice revenues will grow at 8,6% CAGR in the same period. The fate of mobile voice has long been on the cards, given the significant increase in over-the-top offerings such as Skype, WhatsApp and the recently launched Skype for Business. As for the non-voice segment, demand is driven mainly through the need for mobile broadband.

On the graph above we see an inflection point in 2014, with Africa overtaking the Middle-East in year-on-year revenue growth. This suggests a sustained increase in Africa’s subscriber list and cellular coverage for consumers, making it possible to access mobile services. It also predicates a more robust growth forecast in Africa versus the Middle East.

The most impressive mobile growth figures in Africa are found in the mobile data sector; here we see a 14,6% CAGR explosion. Hence, for African mobile operators, growth is being realised through increased adoption of smartphones — and to a lesser extent new service offerings. The challenge to maintain this growth will be the near-ubiquitous adoption of smartphones predicted within the next two to three years, which will likely force operators to aggressively roll out new services.

For the same analysis, the fixed-line market features somewhat bleaker numbers:

Overall fixed-line revenues continue to show negligible growth in the region as voice revenue traces an unabated decline. Voice revenues declined at 4,4% CAGR in the aforementioned period, led by Africa with an even more precipitous drop of 8,3% over the same period. To understand this decline, it is important to realise that there is a general lack of fixed-line infrastructure in the region (especially in Africa). In addition, a distinct lack of enthusiasm prevails for fixed voice (especially among the younger generation entering the market for the first time).

Continued stay of execution

Continued stay of execution

Nonetheless, for the foreseeable future voice will continue to generate large revenue and profit streams for both fixed and wireless operators. Strong voice coverage together with impeccable quality standards will set the benchmark.

Furthermore, operators need to carefully plan and adopt key strategies to reduce voice-related operating expenditure in order to maintain profitability, even as average revenue per user for voice continues to decline.

On the data front, the revenue growth forecast is muted for fixed-line operators due to the fact that, at the low end of the market, copper DSL technologies will find it difficult to compete against similar offerings provided by mobile operators. On the other hand, fixed-line operators are much better placed in markets where fibre has been deployed. That being said, mobile operators are also planning fibre roll-outs in spite of the fact that fibre’s growth prospects are likely to remain limited for the next few years.

In conclusion, both wireline and wireless operators need to up their game by introducing strategic service offerings, adopting clear and transparent governance principles, inventing clever marketing campaigns and targeting key customer segments.

But most importantly, operators must continue to evaluate their ability to deliver strong customer service, timely installations and stringent service-level agreements. This in an attempt to sustain their business operations while realising the subscriber growth and profits required to outperform other operators in the same market.

- De Wett Bischoff is MD of Accenture Communications, Media and Technology, while Aju Kurien is senior manager for technology consulting at Accenture