Ten years ago this week, Steve Jobs took to a stage in San Francisco to unveil the first iPhone. In the intervening decade, Apple’s iconic device has revolutionised the way people communicate.

But as Apple celebrates 10 years since the iPhone was revealed to the world – it went on sale six months later, in June 2007, and has since sold more than a billion units – there is a growing view that things are not as ship-shape at the world’s most valuable company, as measured by market capitalisation, as perhaps they could be.

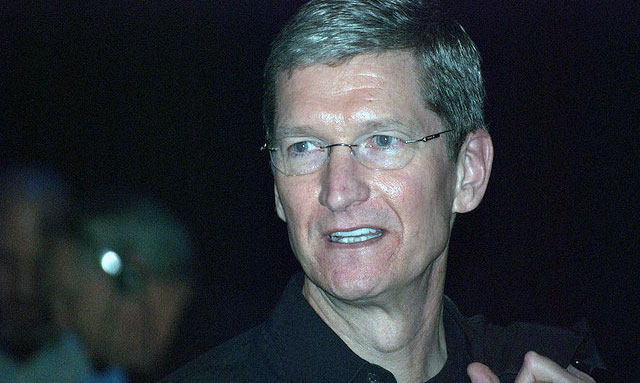

The wheels aren’t coming off (not yet, anyway), but some analysts and Apple watchers have begun fretting that the company has taken its eye off the ball, that without Jobs at the helm it has lost the edge, especially on innovation.

The problem, they argue, is not so much the iPhone – which, in the most recent fiscal quarter, accounted for more than 60% of total revenue (such over-reliance on one product is an obvious risk) – but that the businesses that used to sustain it, like the Macintosh computer line, have become an “afterthought”. The Mac Pro, aimed at the professional market, for example, hasn’t been updated since 2013. And the new MacBooks haven’t been universally well received.

Bloomberg journalist and long-time Apple watcher Mark Gurman wrote in a column in December that people “familiar with Apple’s inner workings reveal that the Mac is getting far less attention than it once did”.

“They say the Mac team has lost clout with the famed industrial design group led by Jony Ive and the company’s software team,” Gurman said. “They also describe a lack of clear direction from senior management, departures of key people working on Mac hardware and technical challenges that have delayed the roll-out of new computers.”

Does this matter, though? After all, Apple makes the vast bulk of its profit from products like the iPhone and iPad, and no longer from the Mac. It might. One problem is, if consumers, fed up by sluggish development on the Mac, move to, say, Windows-based alternatives, they may become less inclined to stay locked into the Apple ecosystem. If Windows works well on the desktop, then what about considering an Android phone instead of an iPhone? And Microsoft, under CEO Satya Nadella, is resurgent – a well-received operating system in Windows 10, paired with sexy new hardware like the Surface Studio all-in-one PC and Surface Book laptops, is making some long-time Apple users sit up and take notice.

Overall strategy seems to be inferior because it is so dependent on bringing out the next big thing, and there may not be one

Indeed, in the past five years, Microsoft’s share price – which trod water for years under former CEO Steve Ballmer – has outperformed Apple’s. A relentless focus on cloud-based software and software as a service is helping Microsoft reinvent itself for a new era.

Perhaps the biggest problem in the longer term – one that’s been written about extensively in recent times – is that Apple has not come up with a new category-defining device since the iPad in 2010, when Jobs was still leading the company.

The Apple Watch was meant to be this product, but smartwatches have proved to be a “much more niche category, and certainly not market making like iPods, iTunes, iPhones or iPads”, said Brian Neilson, director of research at Johannesburg-based consultancy BMI-TechKnowledge.

“Under Steve Jobs, Apple could seize opportunities such as these, being the first to recognise market gaps – like the iPod, a gap Sony left wide open after the Walkman – and to execute well on bringing them to market, incorporating great design and clever marketing,” Neilson said.

“On the design side, the most recent missteps the company has made under the guise of innovation have proven to be highly unpopular – and, frankly, stupid – like eliminating the 3,5mm earphone jack and needing a dongle for just about everything,” he added.

Apple now seems to be playing catch-up in a number of categories

“Worryingly, beyond the design missteps, the overall strategy seems to be inferior because it is so dependent on bringing out the next big thing, and there may not be one.”

Also, instead of being a “market maker”, Apple “now seems to be playing catch-up in a number of categories, including streaming music and home media systems”.

Apple’s reliance on a single product for the bulk of its revenue and profit is hugely problematic, Neilson said. What if the next iPhone is a flop, or it catches fire, like Samsung’s Galaxy Note7, which cost Apple’s Korean rival at least $6bn in write-downs?

Apple’s “vertically integrated” business model — where it controls all aspects of the device, from the hardware to the software and the user experience — has worked well for it, but could ultimately work against it, Neilson added.

“[This model] inevitably loses its shine as competitors emerge at each market layer with equally great products and user experience. Competitors can now innovate more rapidly than Apple can because there are more options, from many more players, in an ‘open systems’ environment, all interoperable.”

- See also: Apple is ‘absurdly cheap’

- This article was also published in the Sunday Times of 15 January 2017