Since the beginning of the year, Vodacom has delivered the best returns for shareholders among listed telecommunications shares, while Telkom has been a noticeable laggard, particularly since mid-2017.

Though Vodacom has performed best overall since 1 January, its share price movement has not been anything to get excited about: it has risen by less than 1%. However, MTN has fallen by 0.5% in the same time, while Telkom has plunged 28.6%.

Blue Label Telecoms, which recently acquired 45% in South Africa’s third largest mobile network, Cell C, has fallen 3.4% since the start of the year.

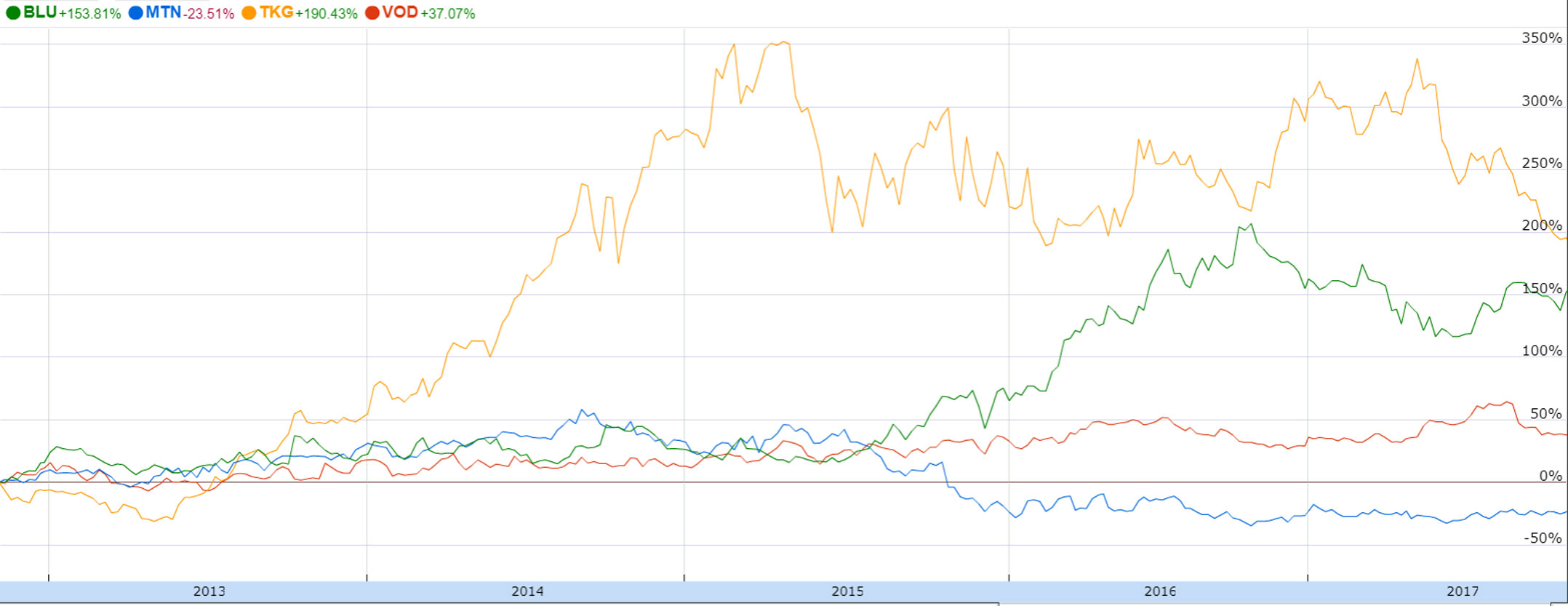

Over a five-year period, however, the picture is markedly different.

Here, Telkom is the star performer, climbing by 190.4%, even though the share has come off sharply since June, when it was up over 300%.

Telkom’s share climbed rapidly in 2013 and 2014 as then-new CEO Sipho Maseko began an aggressive turnaround, which included retrenching thousands of employees and restructuring the business.

It has drifted since 2015, but has come under significant selling pressure in recent months, in part due to government’s plan to sell some or all of its 39.3% shareholding.

Over five years, MTN has been the worst performer, declining by 23.5% — not surprising given its challenges in Nigeria, where it was fined US$1bn (down from an initial $5.2bn) for failing to disconnect more than five million Sim cards. MTN has faced operational challenges in South Africa, too.

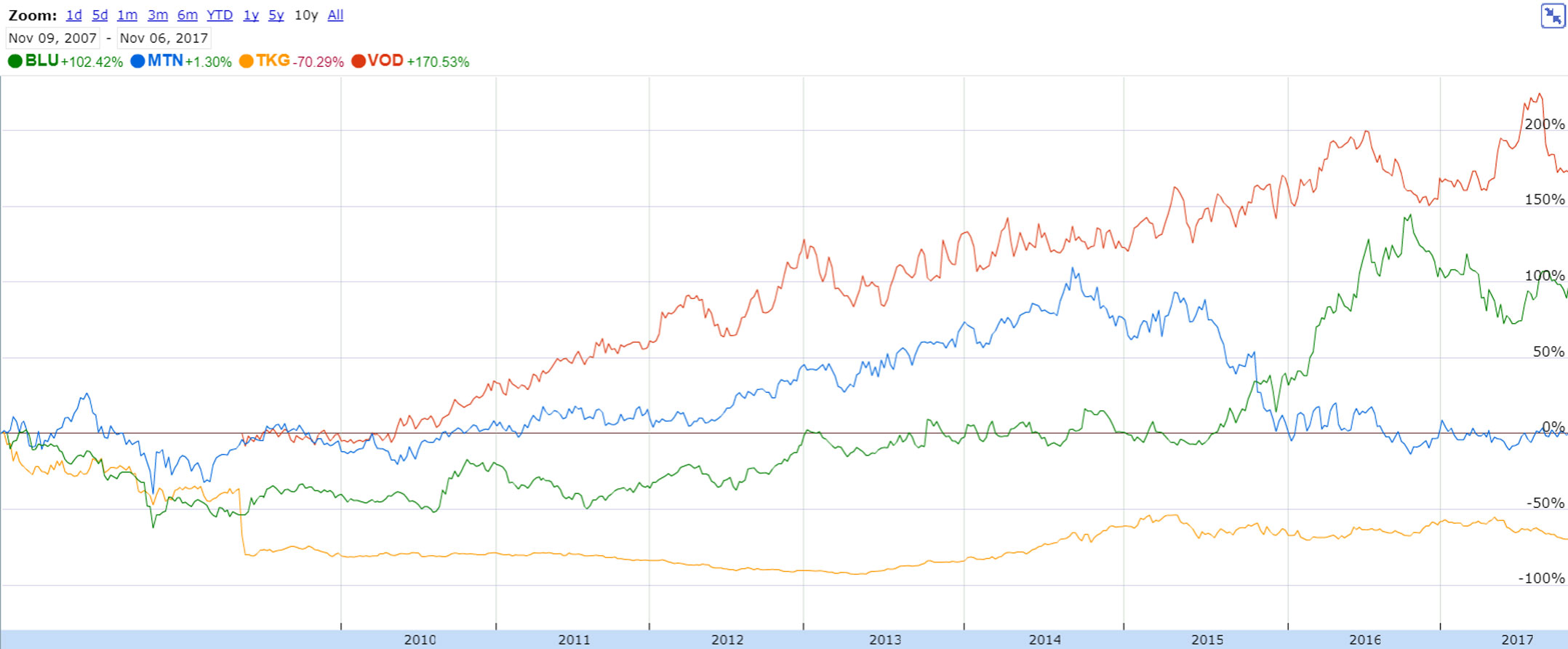

Over 10 years, MTN is still a poor performer, rising by just 1.3%. For those who’ve been invested for a decade, Vodacom is clearly the best performer. Listed since 2009, the company’s share price has appreciated by 170.5% in that time. Blue Label has risen by 102.4%, while Telkom — which sold its 50% stake in Vodacom in 2009 — has fallen by 70.3%.

The above performances do not take into account dividend payments made to shareholders. — (c) 2017 NewsCentral Media