First National Bank is adding a push-based instant messaging service to its smartphone banking application based on its inContact alert service, which will allow users to see a list version of their expenses when they select the messages icon in the app.

The product, when it is rolled out to consumers, could eventually help FNB reduce the millions of rand it currently forks out to mobile operators for the SMS notifications it sends out to its clients.

“Sending inContact as an instant message could potentially have cost savings and efficiency benefits for the bank,” it says. The FNB Banking App has 220 000 active users.

The new version of inContact will present users with a timeline version of expenditure. It was launched to FNB staff at the weekend, with roll-out to customers to follow at an unspecified future later.

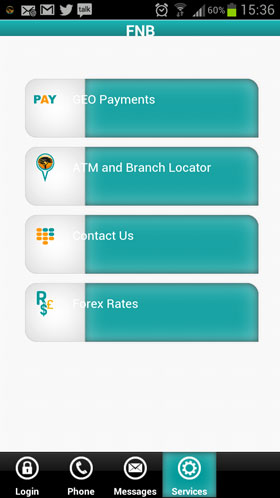

FNB launched its Banking App in July 2011, which included the Connect phone, a software-based telephone developed in-house by FNB Connect. The digital phone allowed customers to make free calls to FNB, as well as other App customers.

In November 2011, FNB added messaging functionality to the FNB App, which allowed users to make and receive instant messages for free to other app users. In May 2012, the phone was updated to allow Premier Banking customers to make free calls as well as message their premier banker for free.

Giuseppe Virgillito, product owner for the FNB Banking App, says presenting inContact as a timeline on users’ phones means they can go to one place to see their inContact messages and not receive them from multiple SMS numbers.

As part of the pilot, FNB staff would initially receive both the instant message as well as the SMS. Users will also be able to customise the message notification limits. — (c) 2012 NewsCentral Media