Meeting a court-imposed deadline with just a day to spare, Icasa has published its final call termination rates for the period from October 2014 to 30 September 2017 — and South Africa’s big operators are likely to be pleased with the outcome.

The communications regulator has announced that it will not cut the rates as aggressively as planned in draft regulations, and will give slightly better “asymmetry” to smaller players than planned.

Mobile operators will continue to charge each other 20c/minute to carry calls between their networks until the end of September 2015, the same rate as now. Asymmetry, whereby smaller players receive more from bigger players than the bigger players pay them, will be 31c/minute for the next 12 months.

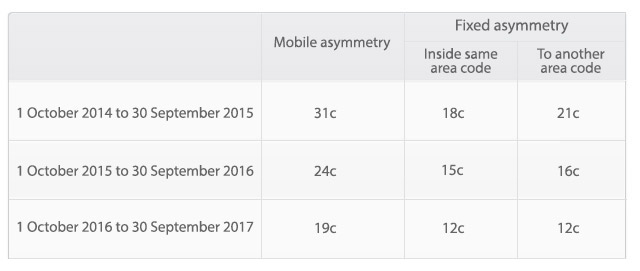

From 1 October 2015 to 30 September 2016, the base rate will be 16c/minute, with an asymmetry of 24c/minute. For the final year, ended 30 September 2017, the rate will fall to 13c/minute, with asymmetry set at 19c/minute (see tables below).

Previously, Icasa had intended to cut the rate to just 8c/minute in 2017, meaning it’s decided to be much less aggressive in cutting the rates.

For call termination to fixed lines in the same dialling code, the rate is set at 12c/minute in the first year, falling to 11c and 10c in years two and three. Between dialling codes, the rates are 15c, 12c and 10c. Asymmetry in the same dialling codes is 18c, 15c, and 12c. Between dial codes, it is 21c, 16c and 12c.

Vodacom has said the process leading up to the publication of the final regulations was “constructive and a good example of how the industry can work with the regulator to get to a scientifically based result”. However, it says it has “some concerns” about the level of asymmetry.

“We appreciate Icasa’s willingness to consult with industry players,” the operator says. “We’re going to review the new rates and will be in a better position to provide comment once that has been completed. We have some concerns about the asymmetry granted to certain companies and the potential impact this could have on our business.”

Although Cell C will continue to benefit from “asymmetry” in the rates for the next four years — it will pay bigger rivals MTN and Vodacom less than they pay it to carry calls between their networks — the level of that asymmetry will be reduced dramatically under Icasa’s final rates.

Cell C CEO Jose Dos Santos expressed disappointment in the draft regulations, accusing Icasa of making a “dramatic U-turn” in its approach to remedying what he called the “current market failure”. — (c) 2014 NewsCentral Media

- See also: Icasa to cut termination rate to 8c