Although the crypto industry began in 2009 with the launch of bitcoin, the growth of overall crypto users and cryptocurrencies in the past two years has been explosive. With more than 18 000 cryptocurrencies available, identifying future giants from fly-by-night coins has never been more important. In the fiercely competitive field of blockchain innovation, a few cryptocurrencies have risen to the top, showing the world that they’re here to stay.

Although the crypto industry began in 2009 with the launch of bitcoin, the growth of overall crypto users and cryptocurrencies in the past two years has been explosive. With more than 18 000 cryptocurrencies available, identifying future giants from fly-by-night coins has never been more important. In the fiercely competitive field of blockchain innovation, a few cryptocurrencies have risen to the top, showing the world that they’re here to stay.

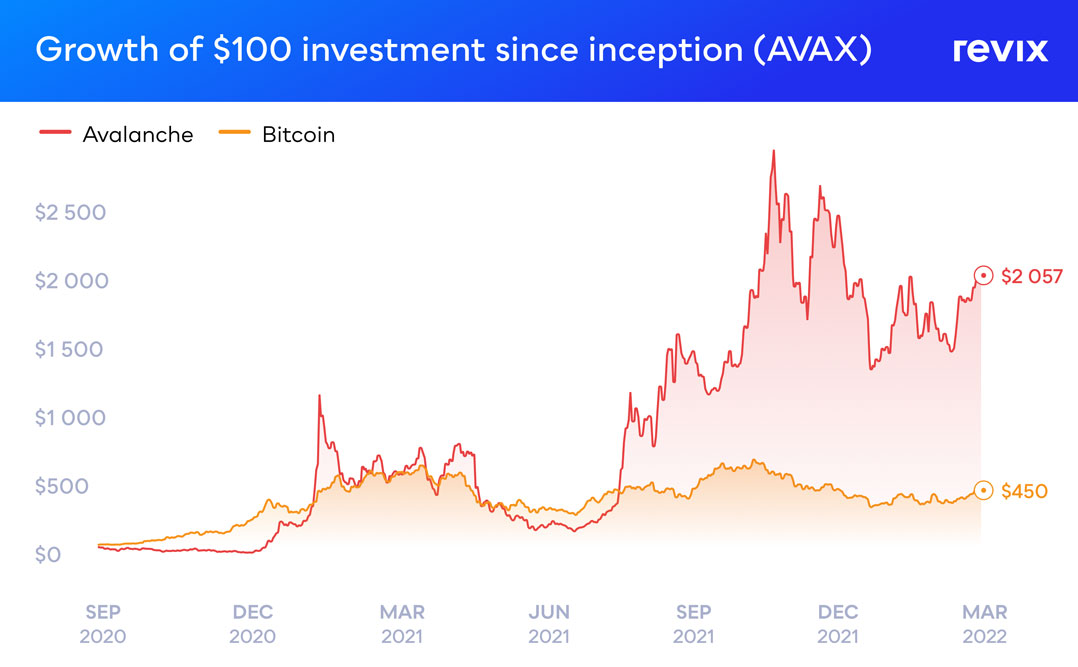

Avalanche, a smart contract blockchain similar to ethereum, was launched in September 2020 and has since climbed its way into the top 10 cryptocurrencies.

Avalanche’s design was aimed at solving some of the limitations of other older cryptocurrencies such as bitcoin and ethereum. Bitcoin was introduced as a peer-to-peer cash system and ethereum as an Internet computer for applications to run on, but they both fall prey to limitations such as speed (transactions per second) and finality (the amount of time it takes for a transaction to be complete). For example, avalanche achieves finality in three seconds versus Ethereum’s one minute.

To learn more visit www.revix.com

Avalanche has one of the most innovative blockchain setups in crypto. Three separate blockchains make up its working structure. By splitting its architecture across separate blockchains, avalanche is able to optimise for flexibility, speed and security, without major trade-offs.

Building a blockchain that can service high numbers of people, called scaling, while maintaining the highest levels of security, all fulfilled on a decentralised network, is known as the blockchain trilemma. Without complicating things, blockchains have to optimise for more scalability, speed or decentralisation. Blockchains like solana that offer the fastest transaction speeds to the highest number of users lean towards scalability, but compromise on decentralisation. Ethereum, the market leader in smart contract platforms, maintains incredible security and decentralisation, while compromising on speed and number of users. By splitting its core tasks over three, interoperable blockchains, avalanche’s innovative design sacrifices the least of all three.

How fast is avalanche?

Bitcoin can handle five transactions per second, ethereum can handle 15 and avalanche can handle a whopping 4 500. This still falls short of solana’s impressive supposed 50 000tps, but avalanche offers better security and is more decentralised.

Another factor that makes avalanche attractive is that it supports and leverages the Ethereum Virtual Machine (sounds cool, but it’s just a virtual engine that runs code and applications). It’s positioned well to interact and integrate with other blockchains.

Rise of the ethereum killers

Ethereum was the major investment thesis during the 2017 crypto bull run because it offered a completely different investment thesis to bitcoin (digital unstoppable cash). Ethereum promised you could build and run any application on the blockchain you wanted, and nobody could stop you – a valuable invention and technology that the world certainly needs.

This birthed a wave of innovation as people wanted to create a better, faster version of ethereum – the “ethereum killers”. Before 2020, most the world hadn’t heard of solana or cardano, or in more recent months, avalanche.

The reason these became household names was because of their insanely fast rise to the top of the cryptocurrency market and investment returns that would put a smile on everyone’s faces.

On top of having returned investors and early believers huge amounts of money, avalanche has established a strong community of investors and developers to make the blockchain better and even more valuable. It’s certainly an asset that Revix, the Cape Town-based investment platform, is excited to launch in the coming weeks. Stay tuned for more!

You’re not too late to be early

You’re not too late to be early

Ready to be an early investor? Avalanche is only two years old and Revix is the first financial platform in South Africa to list the AVAX token.

To celebrate the launch, we’re offering you zero fees when you buy AVAX over the next two weeks. This means that from 22 April to 8 May 2022, you can invest in AVAX completely fee-free!

About Revix

Revix brings simplicity, trust and excellent customer service to investing in cryptocurrencies. Its easy-to-use online platform allows you to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Disclaimer

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more visit www.revix.com.

- This promoted content was paid for by the party concerned