If government decides to get serious about SA Connect, its wide-ranging broadband policy published two years ago, it will result in one of the largest telecommunications projects ever embarked upon in South Africa’s history.

But already the project has fallen behind, with South Africa set to miss milestone targets set for 2016, and 2020 targets already at risk.

This is the view of specialist technology research firm and consultancy BMI-TechKnowledge, which has produced a 200-page report examining what will be needed to connect tens of thousands of government facilities, including schools and clinics, to the Internet at broadband speeds.

BMI-T has developed two models — “two theoretical extremes”, it calls them — one predominantly based on the deployment of fibre infrastructure, and the other relying much more heavily on wireless technologies such as 4G/LTE.

BMI-T MD Denis Smit says government’s hope of achieving its ultimate goal of connecting all South Africans to broadband by 2030 won’t be met “unless there are course corrections and the programme gathers momentum soon”.

“BMI-T has calculated that we need to more than double the current national fibre-optic footprint, regardless of whether we adopt a fibre-centric or a wireless-centric approach,” the company says.

Its report doesn’t make any judgments about whether SA Connect is desirable or even financially feasible, but is rather meant as an “independent review of the project, to contribute to the debate”, says Smit. “We have done a detailed technical and financial model and looked at different scenarios and provided some insight into the scale of the problem. You’re talking about a fibre project on a scale that this country has never seen.”

BMI-T senior telecoms consultant Tim Parle says South Africa has about 25 000 public and private schools. It’s not known how many of these schools are connected, or how they’re connected. There are also about 4 000 health facilities, 1 100 police stations and 1 600 post offices. In all, there are about 39 000 government facilities that need to be connected under SA Connect, according to BMI-T.

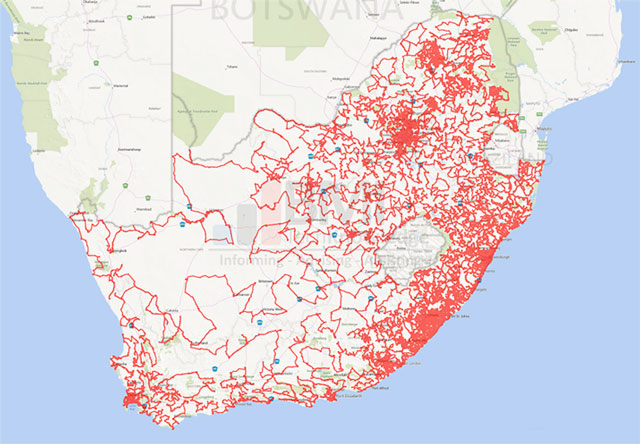

The challenge is that the relatively well-served urban and suburban areas make up only 7% of South Africa’s geographic area; the remaining 93% is rural and generally poorly served by telecoms infrastructure. More than two in five public sector facilities are located in rural areas. Yet, a central requirement of SA Connect is that all facilities and locations are treated equally.

It will be easier to connect facilities in provinces such as Gauteng and the Western Cape, which are heavily urbanised, than in the rural Eastern Cape or KwaZulu-Natal, says Parle.

Although BMI-T has considered “two extremes” in its fibre-centric and wireless-centric models, it believes a mix of the two is the most practical solution. However, even if South Africa opts for a wireless-centric solution – which will be cheaper and quicker to deploy than laying fibre to every end point, and offer better returns on investment – the country will still need to more than double its existing fibre footprint to connect base stations.

BMI-T estimates that Telkom’s national long-distance fibre amounts to about 30 000km. Telkom has been named as government’s preferred partner for the SA Connect project.

In its fibre-centric model, BMI-T estimates that an additional 60 000km of national fibre would have to be deployed, in addition to what Telkom already has in service.

However, even the company’s wireless-centric model calls for significant investment in fibre for backhaul. It estimates that South Africa will need an additional 41 000km of fibre under this model.

“The big ‘lever’ is the involvement of Telkom and access to its fibre – is it the right fibre and is it in the right places?” says Parle. “Then, how much of the new fibre that gets built is aerial, and how much is buried? The costs are very different and there are pros and cons for every engineering solution.”

The scale of the project is perhaps best illustrated when one considers that it took private telecoms operator FibreCo more than two years to secure the necessary permits to roll out 1 000km of fibre between Johannesburg and East London. Just building that link took the company 14 months.

“Under the fibre-centric model, in a typical year we’d need to have six FibreCo-scale projects running in parallel,” says Parle. “Even under the wireless-centric model, it’d have to be at a rate of 3,5 FibreCos a year.”

The biggest challenge, though, could be figuring out the return on investment and how the project will be funded.

“The internal rate of return for wireless is clearly a lot higher than it is with the fibre-centric model,” says Parle. Even then, it’s a massive project that ultimately will deliver small returns. Ten years may be a best-case scenario for a return on investment, says Parle. Adds Smit: “The problem is not necessarily the scale of the investment; it’s funding it over 10 or 15 years. And this only takes into account the infrastructure, not e-government services, tablets that would need to be distributed into schools, and so on. You need to create demand.”

So, can South Africa actually afford SA Connect? “I don’t know,” says Smit. “This is not a business-as-usual situation. If government can afford R1 trillion for nuclear power stations, maybe they can afford this. It depends on political will.”

Though the capital requirements for SA Connect vary largely depending on prioritisation and choices made, the peak funding requirements and the time it will take for the project to become operationally profitable are significant challenges. The money required is “probably far beyond what the state with current funding models can afford”.

However, Smit says it is not BMI-T’s intention with its report to “pass comment” on the feasibility of what is proposed, but rather to present the scale of the problem to government and other industry role players. “These are the facts, this is the scale of the problem, and unless someone addresses the reality of this, we might find things don’t proceed,” he says.

“We want to stimulate debate about this. At this point, it’s fairly opaque as to what’s happening, and the scale of it. There is no formal process of measuring progress on SA Connect. Our attempt here, and it’s only at an infrastructure level, is to put some sort of reality testing into the discussion. Our conclusion is that if we continue as business as usual, SA Connect will be jeopardised.” — © 2016 NewsCentral Media