Snap, the parent company of Snapchat, has filed confidentially for an initial public offering, according to people familiar with the matter.

Snapchat filed papers with the US Securities and Exchange Commission before last week’s US presidential election, one of the people said, asking not to be identified as the details are private.

The company is targeting a valuation of about US$20bn to $25bn in a listing that could come as early as March, the person said. No final decision has been made on the size or timing of the IPO, they said.

The camera-application maker will seek to raise as much as $4bn at a valuation of about $25bn to $35bn, people familiar with the matter said in October, with one adding that the valuation could reach as much as $40bn. Valuations can vary in the lead-up to an IPO as companies may try to temper expectations among investors, while others on the deal are more likely to promote higher numbers.

While the company’s management doesn’t think a Trump presidency is likely to have a negative impact on the business, they will be closely tracking market volatility and could delay the IPO if needed, one of the people said.

Snapchat has more than 150m daily active users and aims to generate more than $350m in advertising revenue this year, up from $59m in 2015, people familiar with its plans have said.

Because Snapchat has revenue of less than $1bn, it was able to file IPO documents confidentially. Under the Jumpstart Our Business Startups Act, companies with smaller revenue can file privately and work out details with the SEC away from the public eye.

A representative for Snapchat declined to comment.

Snapchat chose Morgan Stanley and Goldman Sachs to lead its offering, people familiar with the details have said, giving the former its biggest advisory role on a technology IPO since it led Facebook’s tumultuous listing more than four years ago. JPMorgan Chase & Co, Deutsche Bank, Allen & Co, Barclays and Credit Suisse will also be involved as joint book runners, the people said.

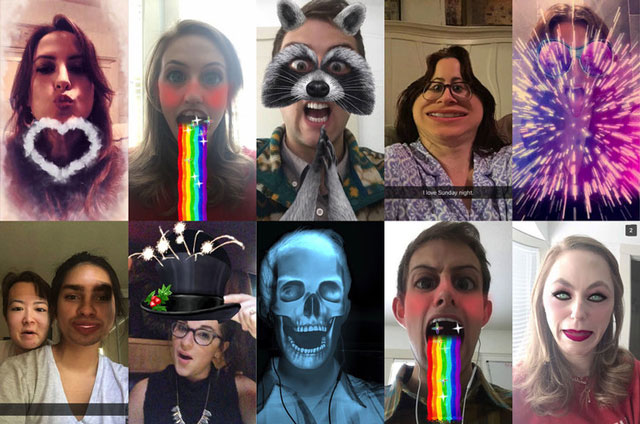

Los Angeles-based Snapchat makes an application for sharing selfies and videos, watching news videos and chatting with friends. Last week, it added a physical product to its lineup, selling $130 Snapchat Spectacles, which come with a built-in camera for shooting video.

After its last funding round, Snap’s private market value reached $18bn, meaning that its IPO would be the biggest of a social media company since Twitter sold shares in November 2013. — (c) 2016 Bloomberg LP