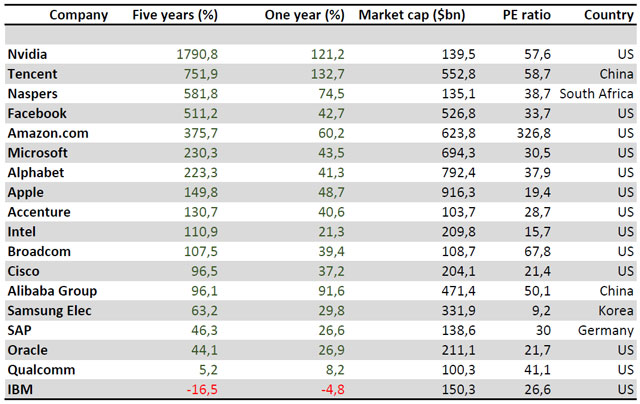

Over the past five years, JSE-listed Naspers was the third-fastest growing technology stock in the world with a current market valuation above US$100bn, pipped only to the post by Tencent, in second place, in which it has a 33.2% stake, and by graphics card giant Nvidia at the top of the list.

An investment in Naspers five years ago would have elicited a 581.8% return, a better return than offered by US technology giants such as Facebook, Amazon.com and Google parent Alphabet. (See the table below for more.)

Naspers has, however, lagged Tencent, which has risen by 751,9% over five years and by 132.7% in the past 12 months.

Global tech shares, which have risen sharply in the past five years, now dominate the top 10 list of most valuable companies worldwide. Apple is the world’s biggest tech company by market capitalisation, worth a stunning $916.3bn at the time of writing. Apple’s share price has risen by 149,8% in the past five years, and some analysts have predicted that it could be the first company to reach a $1 trillion market valuation.

The list excludes telecommunications companies.

Nvidia tops the list of best performers over a five-year window, rising by an incredible 1 790.8% in that period, driven higher by the insatiable demand for computing power by cryptocurrency miners, but also because of strong demand from gamers for high-end graphics cards to power the latest videogames. In the past year alone, Nvidia has climbed by 121.2%, beaten to top spot only by Tencent.

Of tech companies worth more than $100bn, only IBM has gone backwards, losing 16.5% of its value over five years and 4.8% in the past 12 months.

The top five performers over five years are Nvidia, Tencent, Naspers, Facebook and Amazon. Microsoft, Alphabet, Apple, Accenture and Intel round out the top 10.

The list remains dominated by US companies (13 companies), with the only other nations to feature on the list being China (two companies), South Africa (one), Korea (one) and Germany (one). — (c) 2018 NewsCentral Media