Nvidia isn’t expected to announce earnings for another month but results this week from the chip maker’s biggest customers are about to set the tone for its shares, which are trading near an all-time high on optimism around the AI boom.

Microsoft, Alphabet, Amazon.com and Meta Platforms all announce earnings in the coming days. Traders will be paying close attention to their capital spending to gauge demand for Nvidia’s chips, which are prized for artificial intelligence computing. The group accounted for more than 40% of Nvidia’s sales in the second quarter.

Wall Street expects the four tech giants to unveil a record amount of capital expenditures, but any disappointment around the pace of outlays stands to rattle Nvidia shares, which have almost tripled this year, adding more than US$2-trillion in market value. It’s likely to be a pivotal stretch for the entire stock market. Nvidia has been the biggest contributor to the S&P 500 Index’s gains this year, accounting for about a quarter of its 22% advance.

“If these companies come out and broadly say that capex is increasing even at a modest rate, that’s what Nvidia really needs to keep this momentum going,” said Dave Mazza, CEO at Roundhill Investments. “If anything is poor you could see a lot come out of the stock.”

The four tech behemoths are projected to have pumped a combined record $56-billion into capital expenditures in the third quarter, according to the average of analyst estimates. Much of that spending is going to Nvidia and other makers of AI-related gear, and it’s projected to rise further in the coming quarters.

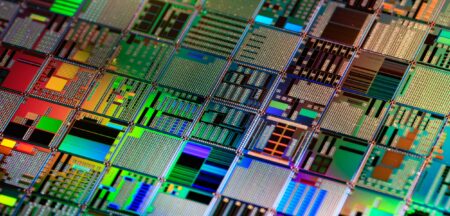

All signs point to continued strength in AI-related spending. From chip equipment maker ASML Holding to Taiwan Semiconductor Manufacturing Co, AI has been a bright spot this earnings season.

Blackwell

That backdrop has helped propel Nvidia shares, along with reassurances from CEO Jensen Huang that production of its new Blackwell chips is on track and in high demand. Nvidia has been the biggest beneficiary of the heavy spending on AI computing equipment. The stock hit a record high last week and its market capitalisation is now roughly $3.5-trillion, just shy of Apple, which is still the world’s most valuable company.

Read: Nvidia overtakes Apple as world’s most valuable company

To be sure, there has been some concern around all the spending on AI by the Big Tech companies, given investors’ perception that the billions of dollars the firms have invested has generated relatively little in revenue. So that will be another focus as the cohort announces earnings this week.

“You’ve got to walk that fine line of investment,” said Paul Marino, chief revenue officer at Themes ETFs, so that investors see you’re “not getting too far ahead of yourself”.

Nvidia’s revenue is projected to more than double this year to $125.6-billion, according to an average of analyst estimates. Next year, sales are estimated to increase 44% to $181-billion, in the chip maker’s 2026 financial year.

Nvidia’s revenue is projected to more than double this year to $125.6-billion, according to an average of analyst estimates. Next year, sales are estimated to increase 44% to $181-billion, in the chip maker’s 2026 financial year.

Of course, there are other beneficiaries of high AI spending for which this week will be important to watch, including Broadcom, Super Micro Computer and Dell Technologies. — Jeran Wittenstein and Carmen Reinicke, with Subrat Patnaik, (c) 2024 Bloomberg

Get breaking news from TechCentral on WhatsApp. Sign up here