Apple shares rose on Tuesday, with the iPhone maker returning within striking distance of record levels as optimism grew that the company’s newest iPhone models were seeing strong demand.

Apple shares rose on Tuesday, with the iPhone maker returning within striking distance of record levels as optimism grew that the company’s newest iPhone models were seeing strong demand.

Shares rose as much as 1.9%, easily outperforming the broader S&P 500 IT sector, which was down 0.5%. The gain was just the latest move higher for Apple, which is up more than 17% from an August low and surging nearly 60% from a January low.

At current levels, the stock is about 2.5% below an all-time closing high that was reached about a year ago.

The latest optimism came after positive comments from CEO Tim Cook, who spoke with the German newspaper Bild in an article dated 30 September. Cook, according to a translated version of the article, said that sales of the iPhone 11 had seen a “very strong start”, and that he “couldn’t be happier” with the launch.

Apple is tentatively expected to report its fourth quarter results on 30 October, and analysts are looking for 41.9 million iPhone shipments in the quarter, according to a Bloomberg MODL estimate. That represents a year-over-year decline of 14.5%. The product is critical for the company; according to data compiled by Bloomberg, more than 60% of Apple’s 2018 revenue came from the iPhone.

Validation

Cook’s comments seemed to validate some early reads from analysts. Evercore ISI wrote that a survey it conducted was “modestly positive”, adding, “surprisingly, despite concerns about a weak cycle, 40% of respondents are interested in buying a new iPhone”. This level of interest is “in line to slightly better” than historical trends, analyst Amit Daryanani said, and the survey results “increase our confidence that Apple can outperform expectations”.

On Monday, JPMorgan wrote that Apple’s 2019 product cycle was “stronger than muted expectations”, while last week, UBS called iPhone demand “decent”, and wrote that the launch of the latest versions “appears strong at least in the US”.

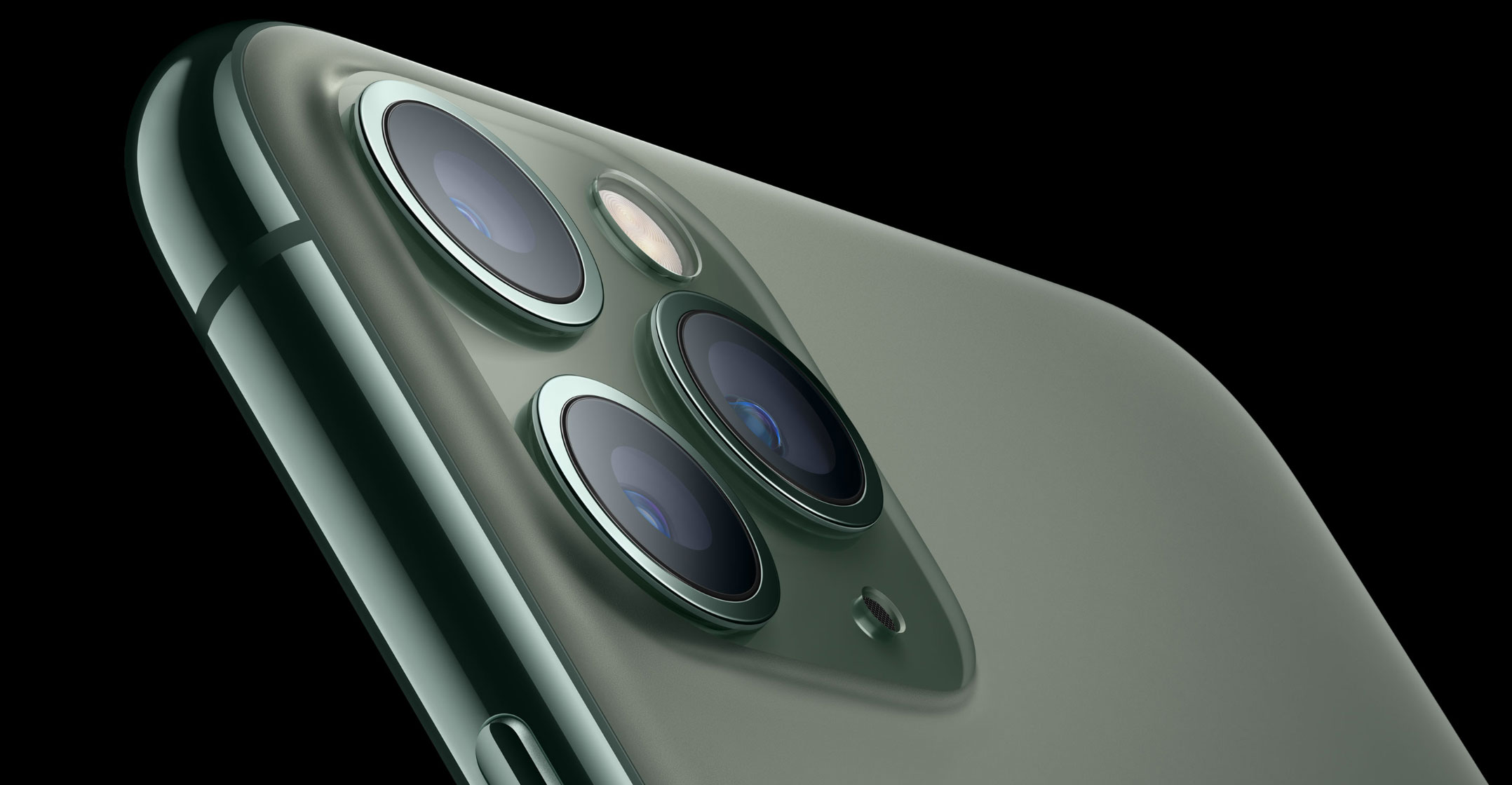

Such bullish views have hardly been unanimous, however. Apple is expected to debut a 5G version of the iPhone next year, and many analysts expect customers will wait to upgrade. KeyBanc Capital Markets said a survey of carriers pointed to “soft demand for the new line-up”, with “lacklustre” interest in the iPhone 11 despite a camera upgrade and US$50 price cut. In September, a Piper Jaffray survey indicated “limited excitement” for the new versions given “the promise of 5G devices on the horizon”.

The anticipated 5G phone could also mean that customers opt for lower-priced models, eroding the closely watched metric of average selling prices. The average iPhone selling price is seen coming in at $770.35 in the fourth quarter, down 3.1% from the year-ago period. — Reported by Ryan Vlastelica, with assistance from Alexander Michael Pearson, (c) 2019 Bloomberg LP