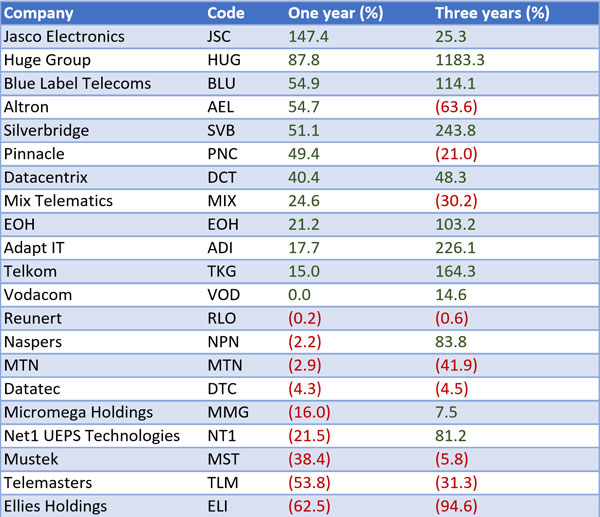

Jasco Electronics, Huge Group and Blue Label Telecoms top the list of best-performing technology shares on the JSE in 2016, TechCentral’s annual analysis of share price performances shows.

Jasco, led by former Siemens South Africa CEO Pete da Silva, shot the lights out in 2016, with its share price rising by almost 150%, handily beating second-placed Huge Group (up 87,7%).

Jasco’s performance was on the back of a successful, multi-year restructuring programme led by Da Silva, which saw the company swing back to profit.

Huge Group, whose share price has risen by an astonishing 1 200% in the past three years, benefited from a stronger operational performance, acquisition plans and the appointment of two top executives — former top banker and equities analyst Duarte da Silva and former MTN South Africa CEO Zunaid Bulbulia — to its board. Huge Group was the top performer in TechCentral’s 2015 list.

Blue Label Telecoms, which a year ago announced it would buy a significant minority stake in mobile operator Cell C, rounded out the top three with an improvement of 54,9% over the year. Investors have piled into Blue Label on strong financial results as well as the opportunity to invest, albeit indirectly, in the unlisted Cell C.

The Venter family-controlled Altron, a poor performer in recent years, showed signs of a turnaround, with its share price jumping by 54,7% in 2016, putting it in fourth place as its restructuring started to bear fruit. Pretoria-based IT solutions provider Silverbridge was fifth best performer, meanwhile, with its share price climbing by 51,1%.

Other strong performers this year included Pinnacle Holdings and Datacentrix — with the former announcing plans to buy out minority shareholders in the latter.

Historically strong performers, IT services businesses Adapt IT and EOH, had a more muted 2016, with their shares rising by 17,7% and 21,2% respectively.

South Africa’s big telecommunications companies delivered a mixed performance. Telkom outshone its rivals, climbing by 15% on the turnaround in its mobile business, while Vodacom ended the year flat.

MTN, which spent the year fighting fires on several fronts — not least in Nigeria, where it managed to reduce a regulatory fine to US$1bn from the original $5,2bn — ended the year down by 2,9%. All eyes will be on MTN in the coming months as new CEO Rob Shuter takes the reins.

The year’s worst performers were Mustek (down by 38,4%), Telemasters (a negative 53,8%) and Ellies Holdings (which had 62,5% wiped off the value of its shares). Ellies’ share has fallen by almost 95% in the past three years. — © 2017 NewsCentral Media