Nvidia, which walked away from a $40-billion acquisition of ARM earlier this month, failed to impress investors with its latest forecast, a sign of the lofty expectations for the most valuable US chip maker.

Though the company topped Wall Street estimates with its latest quarterly results on Wednesday — and projected strong growth for the current period — the shares slipped as much as 5.3% in late trading.

The company’s adjusted gross margin, meanwhile, was 67% last quarter — just shy of the 67.1% analysts predicted.

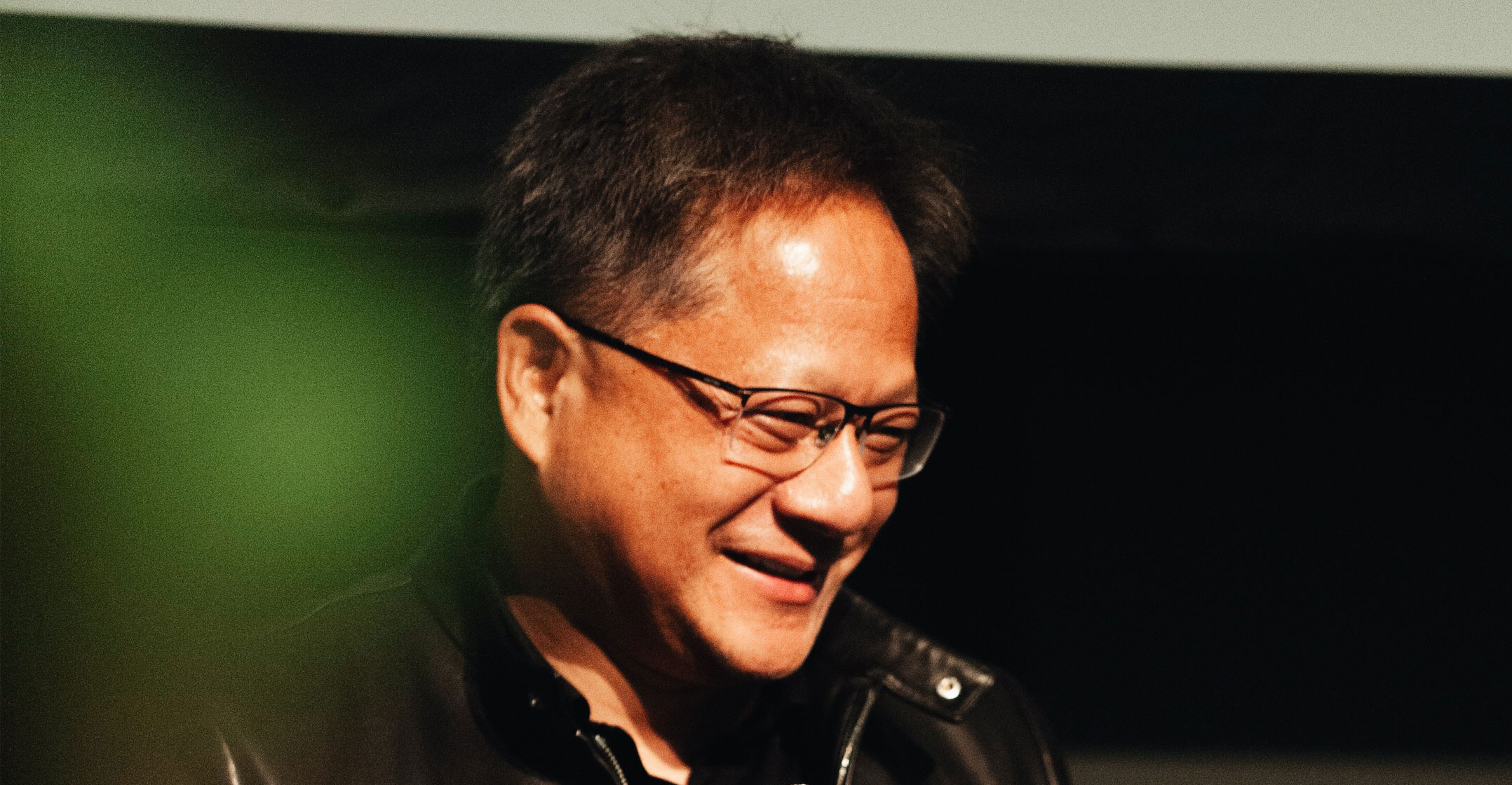

CEO and co-founder Jensen Huang has turned a niche business — graphics cards for gamers — into a chip empire worth more than US$600-billion. But investors have high hopes for the company, and even a record-setting quarter can leave them underwhelmed.

The company also is bouncing back from its failed attempt to acquire ARM, a deal that faced regulatory opposition around the world. It terminated the transaction on 8 February and expects to write off $1.36-billion this quarter to account for pre-payments it pledged to ARM’s owner, SoftBank Group.

Upbeat

Even without ARM, Nvidia has been growing more quickly than projected. Revenue in the fiscal first quarter will be about $8.1-billion, the company said on Wednesday. That compares to a $7.2-billion average analyst estimate.

The Santa Clara, California-based company has pushed into the booming field of artificial intelligence computing, where its processors are used to handle an ever-growing flood of data. That’s turned Nvidia’s products into essential equipment for data centres, rather than just gaming computers.

Nvidia posted sales of $7.64-billion in the fourth fiscal quarter, topping the $7.4-billion average prediction from analysts. Earnings came in at $1.32/share, excluding some items, compared to an estimate of $1.22. — (c) 2022 Bloomberg LP