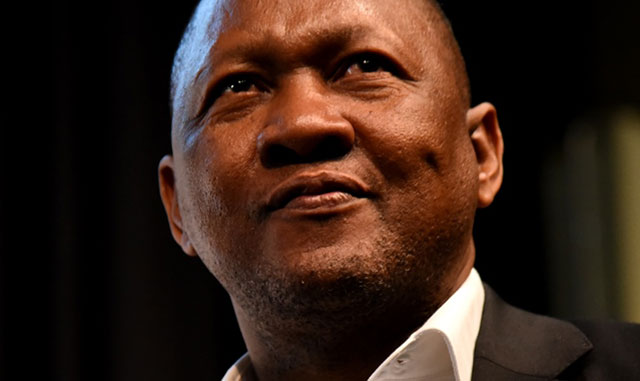

Dimension Data Middle East and Africa chairman Andile Ngcaba has called on communications regulator Icasa and government to ensure that high-demand spectrum in the so-called “digital dividend” bands and at 2,6GHz are licensed using the open-access model of telecommunications.

Ngcaba, who is also the controlling shareholder in Convergence Partners, says open access — where infrastructure is separated from services — is the best and most sustainable model for both fixed and wireless telecoms in South Africa and in the broader region.

“South Africa is at a juncture where it is looking at [licensing] 2,6GHz and the digital dividend,” Ngcaba says. “We argue that it’s the best model in order to allow an equitable environment, one where new entrants and incumbents can operate in a market that is fair from a competition point of view.”

Telecoms and postal services minister Siyabonga Cwele said in an interview with TechCentral this week that his department is working to finalise government policy on high-demand spectrum, including bandwidth in the digital dividend bands, which will become available when South Africa completes its long-delayed migration from analogue to digital terrestrial television.

Though a number of South African operators, including the largest mobile operator, Vodacom, are opposed to the idea of open access in the cellular industry, Ngcaba believes it is inevitable. “I emphasise that it’s happening everywhere in the world, in the UK, in France, in the US.”

He says open access is the best model to ensure operators can keep up with rapidly growing demand from consumers for data. It also makes sense in deploying infrastructure affordably in rural and underserviced parts of the country.

Open access is drawing attention from at least one local industry player that in the past wouldn’t have considered it. Telkom CEO Sipho Maseko said this week that the operator’s first fibre-to-the-home deployments will provide a testbed for providing services on an open-access basis and that this may be extended to the company’s traditional copper-based digital subscriber line network over time.

In telecoms, open-access networks involve the separation of the infrastructure and services layers. Though often favoured by new entrants, the open-access model is often shunned by incumbent operators, which tend to favour a more vertically integrated approach where they provide most if not all services to end-user consumers.

Ngcaba says open access makes sense in new fibre deployments, in part because it reduces duplication of infrastructure. “One trench could be used by many operators,” he says. “We can’t have everyone with the right to dig. At the metro level, there isn’t an abundance of space alongside the street for you to build trenches for each operator.”

The same, he says, applies to the building of mobile base stations for next-generation 4G/LTE networks.

He says Dimension Data division Internet Solutions is “involved in discussions with different people to ensure this is the model that is adopted”.

“We are talking to colleagues at the FTTH Council Africa and other bilateral [forums] to ensure there is open access in fibre. We’re also talking to the metros to say to them that the best way to build metro connectivity is open access. We’ve had the same discussions with the likes of [roads agency] Sanral to present open access as the key infrastructure development model to ensure we can provide customers with the best services.”

In underserviced parts of the country, it’s the only model that makes sense for delivering broadband, he adds. In these areas, duplication of infrastructure is simply not feasible. “Clearly, you have to have common infrastructure to provide services in rural areas,” Ngcaba says.

He downplays concerns that having only one infrastructure provider will lead to a monopoly and high prices. Pricing must be transparent, he says.

“The big problem is if the company providing the infrastructure also competes with you. You need to separate that.” — (c) 2014 NewsCentral Media