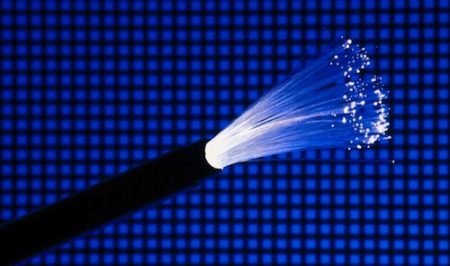

In a development that could change the dynamics of SA’s telecommunications industry, mobile operator Cell C, Dimension Data division Internet Solutions and Andile Ngcaba’s Convergence Partners have teamed up to build a R5bn, 12 000km national fibre-optic network.

Browsing: Neotel

Cell C does not deserve an asymmetrical interconnect rate 10 years after entering the market and the decision to offer the company asymmetry is “unfair”. That’s the view of MTN SA MD Karel Pienaar, who was reacting to the news that the

The Independent Communications Authority of SA (Icasa) has introduced an asymmetric wholesale call termination regime that benefits smaller market players, including Cell C, Neotel and Telkom’s 8ta.

Neotel is looking for a “sustainable” way to bring fibre access to SA users’ homes. The company’s chief technology officer, Angus Hay, says that at the moment, building fibre into homes is an expensive exercise

SA’s telecommunications industry has assembled on the battlefield with two players, one new, Telkom’s mobile business 8ta, and one reinvigorated, Cell C, getting ready to take on the giants of industry. Some smaller players are gathering on the flanks and others may yet make an entrance.

Neotel expects to double the number of retail consumers using its network within the next six to nine months as a direct result of its launching its first prepaid services. MD Ajay Pandey says he’d be

Telecommunications operator Neotel is back for another stab at the consumer market, relaunching its offerings in voice and entry level broadband. The company, which has struggled to make a meaningful impact in the consumer telecoms space

Falling mobile termination rates and slow recovery of the economy are dampening the growth of SA’s telecommunications market. That’s according to a new report from BMI-TechKnowledge (BMI-T). The report forecasts that the industry will grow only 5% over the next five years, with most of that growth coming from data services.

The East Africa Submarine System (Eassy) cable has not made the sort of splash on the SA broadband market as many had expected it to. The 10 000km-long submarine fibre cable, which runs along Africa’s east coast, is the second new cable to arrive on SA shores in the past year. The first was Seacom, which went live in 2009.

With more than half a dozen SA operators rolling out their own national networks, consolidation in SA’s telecommunications industry looks inevitable. There’s a chance Cell C and Dimension Data could be the ones to kick it off. Didata division Internet Solutions looks a bit like the odd man out these days. The converged service provider, which remains a powerful force in the corporate market, is the only big player in its space that doesn’t have its own significant investment in telecoms infrastructure.