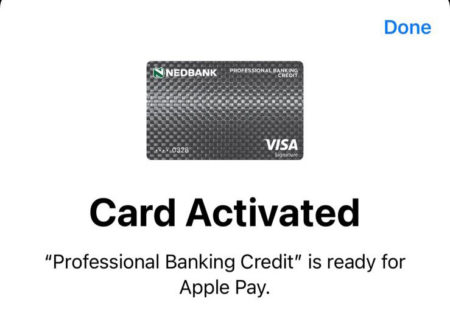

Apple Pay has finally been launched in South Africa. Customers from Nedbank, Absa and Discovery Bank were on Tuesday morning able to load their bank cards into their Apple wallets.

Browsing: Apple Pay

Apple on Tuesday found itself the target of two EU antitrust investigations into its App Store and Apple Pay as regulators said its terms and conditions and restrictions may violate the bloc’s competition rules.

Five years after its ballyhooed debut, Apple Pay is still struggling to take off. Apple is betting its swanky new credit card can change that.

Ever since computers were first introduced into the retail banking system in the late 1950s, there has been the vision of a future world where cash is obsolete. The near death of personal cheques, increase in debit and credit card use, and innovations such as PayPal

Stafford Masie, the South African technology entrepreneur behind the Payment Pebble, introduced earlier this year by Absa, will on Monday takes the wraps off a radical new design of the mobile point-of-sale (M-POS) system. Instead of merchants

Apple Pay has been launched to much fanfare. People with the iPhone 6 or 6 Plus are now able to make credit card payments at certain shops and restaurants in the US. But Apple Pay isn’t the first of its kind and the technology it uses has actually been around for the past 15 years. So why has

When Apple revealed its latest products to the adoring faithful last Tuesday, most people were focused on the gadgets. The new iPhone (it’s bigger) and the Apple Watch (it’s not just a rumour). But the potential game changer is really Apple Pay. Sure, the bigger (and much bigger) iPhone is going

Apple has finally got the “big” religion. America’s biggest smartphone maker on Tuesday unveiled two new and larger-screen iPhones at a glitzy launch event in San Francisco. The event, which was one of the most anticipated in recent years

Apple on Tuesday unveiled a platform it says will allow people to ditch their wallets and use their smartphones — iPhones, of course — to make card payments. If it sounds familiar to South Africans, that’s because local start-ups such as FlickPay, SnapScan