Europe’s SES group, which operates a worldwide fleet of more than 40 communications satellites, is establishing a bigger presence in SA ahead of the launch later this year of a new, high-capacity satellite

Browsing: TopTV

Here they are. TechCentral’s top-five newsmakers of 2010. Our “Newsmakers of the Year” award is presented to individuals we believe had the biggest impact on SA’s technology sector in the past 12 months. For the most

MultiChoice added more than 360 000 new subscribers in SA in the six months to 30 September, handily beating its new rival On Digital Media, which launched TopTV in May

TopTV will launch high-definition channels next year as it takes its fight for subscribers with incumbent pay-TV operator MultiChoice to the next level. The company, owned by On Digital Media (ODM), says it expects to launch

MultiChoice has added three additional Internet service providers as distribution partners for its DStv On Demand Internet streaming service. They are Vox Telecom, Neology and Cybersmart. The company launched its first online on-demand video offering through MWeb just two months after the Internet service provider came to market with an aggressively priced uncapped broadband service.

The apparent collapse of pay-TV operator Super 5 Media is unfortunate. It means less chance of the kind of rivalry that fosters innovation and drives down prices. At the top end of the market, however, competition to DStv may come from a less obvious source. Super 5 Media, formerly known as Telkom Media, was cursed almost from the start. When Telkom, under former CEO Reuben September, decided to end its investment, the writing was already on the wall.

The Independent Communications Authority of SA (Icasa) has received a written assurance from pay-TV licensee Super 5 Media that it is still in operation. “We received a communiqué from Super 5 Media a week before last clarifying its position in relation to recent press reports,” says Icasa spokesman, Paseka Maleka.

Three years ago, when the Independent Communications Authority of SA (Icasa) licensed three new pay-TV players, most of us couldn’t wait to see something super. Four new companies were given a chance to bring new shows to SA’s TV screens. Most importantly, they were supposed to provide competition to the incumbent monopoly, MultiChoice.

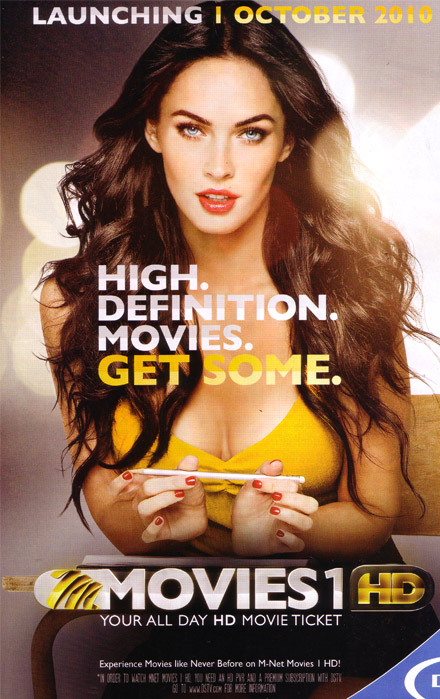

Broadcaster MultiChoice is again expanding its high-definition (HD) portfolio, with plans to launch an HD movie channel on 1 October, TechCentral has learnt. The channel, to be called M-Net Movies 1 HD, will join the four HD channels MultiChoice has already launched on its DStv Premium bouquet.

Pay-TV competition? What pay-TV competition? Naspers-owned MultiChoice grew its SA subscriber base by 450 000 to 2,8m homes in the 2010 financial year. And it added 1,1m new subscribers in other African markets. SA consumers, it would appear, weren’t tempted to put off their purchasing decisions until after the May launch of On Digital Media’s TopTV, the first direct competitor to MultiChoice